- Datawallet Daily

- Posts

- Bank of England Plans Stablecoin Rules to Match US Pace

Bank of England Plans Stablecoin Rules to Match US Pace

Newsletter Issue #666

GM. The Bank of England will roll out its stablecoin framework on Monday, vowing to move “as quickly as the US” as transatlantic policy alignment accelerates under the new crypto era.

Meanwhile, Ireland fined Coinbase $25m for AML lapses, Robinhood crushed earnings on record crypto volume, and Mastercard is testing Ripple and Gemini stablecoin payments.

Here’s what’s closing the week in regulation, revenue, and stablecoin rails. 👇

Bank of England Plans Stablecoin Rules to Match US Pace

The Bank of England will unveil its long-awaited stablecoin regulatory framework on Monday, pledging implementation “just as quickly as the US.” Deputy Governor Sarah Breeden announced the timeline at the SALT conference in London, dismissing criticism that Britain is lagging behind global counterparts.

The framework follows the US GENIUS Act, signed by President Trump in July, which ignited cross-border momentum for stablecoin adoption. Breeden said the UK regime represents a “fabulous opportunity” to align international standards and ensure financial stability through synchronized rulemaking.

Britain’s proposal will temporarily cap holdings at $26,087 for individuals and $13 million for businesses, with exemptions for large exchanges. Breeden downplayed market concerns about the limits, citing structural differences between American mortgage securitization and UK commercial banking systems.

Industry leaders, including Wincent’s Paul Howard, welcomed the timeline as “vital for safeguarding jobs in Britain’s 40% GDP financial sector.” The joint US-UK crypto task force will deliver further policy recommendations by March 2026 to streamline cross-border capital movement and regulatory alignment.

Ireland Fines Coinbase $25 Million for Compliance Failures

The Central Bank of Ireland fined Coinbase Europe $25 million for extensive anti-money laundering monitoring lapses between 2021 and 2025. Regulators said faulty software left over 30 million transactions worth $202 billion unmonitored for nearly a year. Coinbase later filed 2,708 delayed reports involving potential criminal proceeds from fraud, cyberattacks, and other illicit activities.

Coinbase admitted the violations and accepted the fine after a three-year internal review revealed coding and oversight errors. The company said it has strengthened transaction screening and enhanced compliance testing across European operations. Irish officials emphasized that robust controls are critical given crypto’s cross-border risks and attractiveness to organized criminal networks.

Robinhood Earnings Beat on Record Crypto Volume

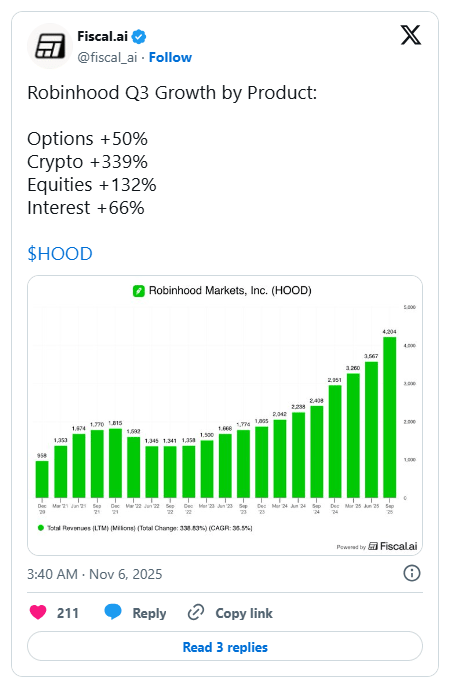

Robinhood reported third-quarter earnings that exceeded forecasts, driven by a 339% surge in crypto trading revenue. The brokerage processed $80 billion in digital asset volume, lifting crypto income to $268 million compared with $61 million last year. Adjusted earnings reached $0.61 per share, surpassing expectations despite a 2% dip in after-hours trading.

Chief Financial Officer Jason Warnick said new business lines, including Bitstamp and Prediction Markets, boosted annualized revenue above $100 million. The company’s total market value climbed to $126 billion, eclipsing major rivals such as Coinbase. Robinhood continues expanding its crypto reach through global acquisitions as user adoption strengthens across equity and digital asset markets.

Mastercard Tests Ripple and Gemini Stablecoin Payments

Mastercard is working with Ripple and Gemini to settle fiat card transactions using RLUSD stablecoins on the XRP Ledger. The companies said the pilot will enable regulated banks to process traditional card payments through a public blockchain network. Gemini’s partnership extends to WebBank, which issues its XRP and Solana-branded credit cards offering token-based rewards.

Mastercard said the collaboration supports its strategy to integrate blockchain settlement within existing financial infrastructure. Humanity Protocol also joined to provide digital identity features for credit and lending products under the same initiative. The effort reflects growing institutional interest in combining stablecoins and open blockchain rails to modernize retail payment ecosystems worldwide.

Data of the day

US spot Bitcoin ETFs recorded $2.04 billion in redemptions over six days, their second-worst streak on record. Wednesday alone saw $137 million in net outflows, extending consecutive declines led by institutional liquidations since late October. The withdrawals follow February’s record $3.2 billion sell-off, when single-day redemptions exceeded one billion dollars.

Ether ETFs also posted heavy losses, shedding $118 million as Solana funds attracted smaller inflows over the same period. Analysts said sustained selling pressure reflects profit-taking after recent highs and caution ahead of tariff-related court rulings. Bitcoin traded near $100,000 on Thursday as investors rotated into stable assets amid broader market uncertainty.

More breaking news

Solana, Fireblocks, Monad, and other major networks formed the Blockchain Payments Consortium to create unified cross-chain standards for stablecoin global payment settlements.

Circle revised its USDC policy to allow lawful firearm purchases, igniting debate over regulatory pressure, political neutrality, and financial censorship risks.

Cathie Wood reduced ARK Invest’s Bitcoin bull case by $300,000, noting stablecoins’ explosive growth in emerging markets is redefining crypto’s monetary hierarchy.

The US government shutdown entered a record 36th day, stalling market structure negotiations and pushing comprehensive crypto legislation closer to 2026 approval.

Synthetic stablecoin USDX collapsed below $0.60 after liquidity stress and liquidation issues, forcing Lista DAO and PancakeSwap to execute emergency protective measures.

.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.