- Datawallet Daily

- Posts

- Bitcoin Hits $91,300 as Trump Captrures Venezuela's Maduro

Bitcoin Hits $91,300 as Trump Captrures Venezuela's Maduro

Newsletter Issue #707

GM. Bitcoin ripped past $91,000 as Trump’s removal of Venezuela’s Nicolás Maduro jolted markets and triggered more than $130 million in short liquidations during crypto’s fiery New Year rebound.

Meanwhile, lawmakers eye insider trading rules for prediction markets, Bitfinex hacker Ilya Lichtenstein secures early release, and BitMine stock jumps on a massive share expansion plan.

Here’s what’s driving the first big crypto rally of 2026. 👇

Bitcoin Hits $91,300 as Trump Captrures Venezuela's Maduro

Bitcoin surged past $91,300 this Sunday as traders reacted to Donald Trump removing Nicolás Maduro in a dramatic Venezuelan power shift. This sudden geopolitical upheaval sparked aggressive risk appetite across digital asset markets during the early 2026 price rebound.

The United States assumed control over Venezuelan oil reserves while the Supreme Court granted Vice President Delcy Rodríguez acting presidential powers. This intervention triggered massive short liquidations totaling $133 million as bear positions collapsed under intense buying pressure from speculators.

Simultaneously, the United States National Debt surged past $38.5 trillion during the 17th anniversary of the historic Bitcoin Genesis Block. Investors celebrated this milestone by pivoting toward decentralized assets while fiat currency confidence eroded under relentless government printing by the treasury.

Thin liquidity amplified modest spot demand to catapult prices through critical technical levels, forcing leverage resets across major trading platforms. Professional speculators utilized these volatile headlines to ignite a sharp breakout, validating Bitcoin’s fixed supply scarcity and market strength.

Torres Targets Prediction Market Insider After Maduro Bet

Representative Ritchie Torres plans introducing legislation targeting insider trading risks on prediction markets following a wager. It comes after a trader reportedly earned $400,000 betting on Nicolás Maduro’s capture before public disclosure. The proposal focuses on federal officials exploiting material nonpublic information obtained through government duties or access.

The bill would bar lawmakers and executive employees from trading contracts tied to policy outcomes federally. Attention intensified after markets moved hours before confirmation of US military action in Caracas overnight strikes. Torres aims securing bipartisan support while exchanges reiterate internal rules banning insider activity on predictions platforms.

Bitfinex Hacker Lichtenstein Claims Early Release

Bitfinex hacker Ilya Lichtenstein announced early release from prison citing reforms under Trump’s First Step Act. Lichtenstein was sentenced in 2024 for laundering bitcoin stolen during the $4 billion exchange breach incident. He credited rehabilitation provisions and cooperation with authorities recovering assets in the largest US crypto seizure.

Officials confirmed Lichtenstein is on home confinement consistent with Bureau of Prisons policies and federal statute. His wife Heather Morgan was also released earlier after pleading guilty to money laundering charges federally. Lichtenstein said he plans returning to cybersecurity work and learning artificial intelligence developments after four years.

BitMine Shares Jump After Proposed Massive Share Expansion

BitMine shares jumped 14% after chairman Tom Lee proposed expanding authorized shares dramatically to support growth. Lee asked shareholders to approve increasing authorized shares from 500 million to 50 billion total count. Investors reacted positively as the stock traded near $30.93 during Friday afternoon sessions in US markets.

Lee said that if ether prices go up, BitMine shares could go above $500 without any changes to the company's structure, making it one of the leading crypto stocks. BitMine holds roughly 3.41% of circulating ETH, totaling more than 4.1 million ether after recent purchases. Shareholders must vote by January 14 to determine approval of the proposed capital structure changes ahead.

Data of the day

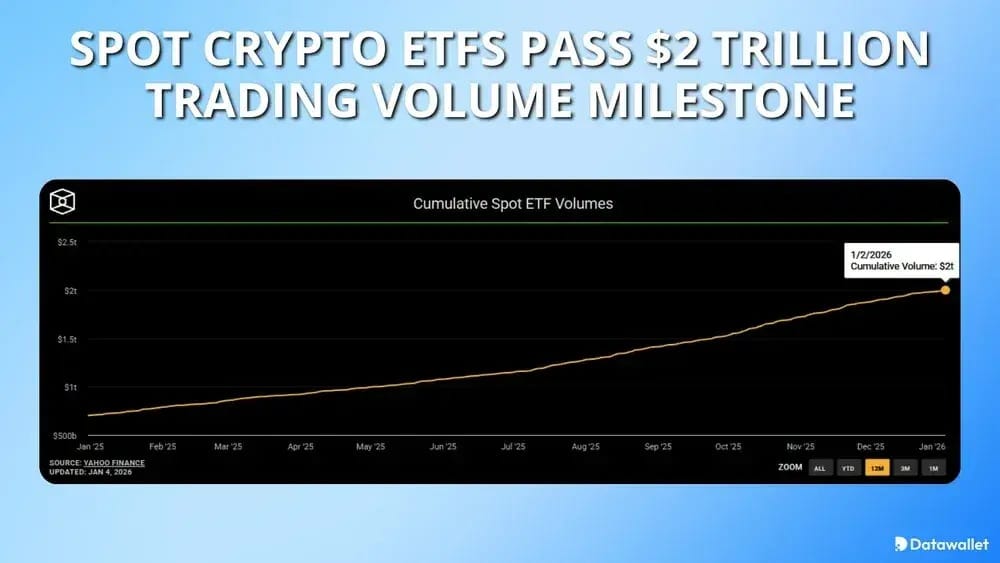

US spot crypto ETFs surpassed $2 trillion cumulative trading volume less than two years after launch. Data shows volumes doubled from $1 trillion to $2 trillion within eight months during 2025 period. Faster SEC listing standards expanded offerings to assets including Solana, XRP, Dogecoin, and Chainlink across markets.

Bitcoin and Ethereum ETFs began 2026 with $645.6 million net inflows on January 2 trading session. Bitcoin ETFs added $471.1 million while Ethereum products attracted $174.4 million collectively according to market data. Analysts expect further growth as institutional demand and pending filings reshape regulated crypto access globally ahead.

More breaking news

ZachXBT reported over $107,000 stolen from EVM wallets in an ongoing attack targeting small balances, with the root cause still unknown.

Coinbase will suspend Argentine peso services on Jan. 31, 2026, pausing fiat operations while maintaining crypto functionality and partnerships via Base.

Iran has begun accepting cryptocurrency payments for advanced weapons imports, signaling a major geopolitical and economic shift toward blockchain-based settlement mechanisms.

Bitfarms sold its $30 million Paraguay facility to exit Latin America, redirecting proceeds toward AI and high-performance computing infrastructure in North America.

SEC Commissioner Caroline Crenshaw’s departure leaves an all-Republican panel, marking a regulatory shift toward pro-crypto policies and reduced Democratic oversight at the agency.

Aave founder Stani Kulechov unveiled a new strategy emphasizing real-world assets and plans to distribute non-protocol revenue directly to AAVE tokenholders.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

1