- Datawallet Daily

- Posts

- Circle Launches Arc Testnet With Wall Street Giants

Circle Launches Arc Testnet With Wall Street Giants

Newsletter Issue #659

GM. Circle launched the Arc testnet with over 100 institutional partners, including BlackRock, Visa, and Goldman Sachs, positioning its new Layer 1 as Wall Street’s onchain operating system.

Meanwhile, Bitwise readies a Solana staking ETF, Securitize plans a $1.25 billion Nasdaq listing, and a trading bot sent Hyperliquid’s HYPE token briefly soaring to $98.

Here are the details on these and other top crypto stories from the last day. 👇

Circle Launches Arc Testnet With Wall Street Giants

USDC issuer Circle has launched the public testnet for its Layer-1 blockchain Arc, featuring over 100 corporate and institutional participants. BlackRock, Visa, Goldman Sachs, AWS, and Coinbase joined the network’s debut, marking one of the broadest enterprise collaborations in crypto infrastructure.

Arc is designed as an “Economic Operating System” offering dollar-based fees, sub-second transaction finality, and optional privacy for regulated financial use cases. Circle CEO Jeremy Allaire described the project as a bid to build an open, internet-native framework for global economic coordination and value transfer.

The testnet includes major banks and exchanges such as Deutsche Bank, HSBC, Kraken, and Robinhood alongside regional stablecoin issuers from Japan, Brazil, and Canada. Each participant will test financial applications spanning lending, capital markets, and cross-border payments.

Circle currently stewards the blockchain but plans to shift Arc toward decentralized governance with a broad validator set and community-driven oversight. The company said this transition will ensure sustainable growth while embedding distributed control among global financial stakeholders and enterprise validators.

Bitwise to Debut Solana Staking ETF on NYSE

Bitwise Asset Management will launch its Solana Staking ETF, ticker BSOL, on the New York Stock Exchange Tuesday. The firm said it is the first US exchange-traded product offering one hundred percent spot exposure to Solana. CEO Hunter Horsley noted the listing represents a new milestone for digital assets entering mainstream institutional investment channels.

Industry advocates called the debut a recognition of Solana’s role in powering global financial infrastructure for blockchain applications. The ETF’s arrival coincides with multiple new crypto listings, including planned Litecoin and HBAR funds on Nasdaq. Bitwise confirmed accredited investors could access BSOL under the SEC’s temporary approval framework during the ongoing government shutdown.

Securitize Targets Nasdaq Listing Through $1.25B SPAC Deal

Blockchain tokenization platform Securitize announced plans to go public via a merger with Cantor Equity Partners II. The proposed transaction values Securitize at approximately $1.25 billion and could see its stock trade under the ticker SECZ early next year. The company said it will also issue digital representations of its shares onchain after completion.

Securitize expects to raise nearly $470 million from the deal, including capital from existing backers like BlackRock and ARK Invest. CEO Carlos Domingo said the listing marks a step toward profitability and market consolidation within the real-world asset tokenization sector. Analysts described the firm’s growth as pivotal to bridging traditional finance with regulated onchain securities infrastructure worldwide.

Trading Bot Sparks $98 HYPE Token Surge on Lighter DEX

A trading bot triggered an abrupt price spike on Lighter DEX, doubling Hyperliquid’s HYPE token value to $98 Monday. The algorithm rapidly cleared thin order books, creating a brief liquidity vacuum before the market corrected within minutes. Onchain records confirmed the anomaly, though the DEX later removed the extreme wick from its official chart interface.

Analysts said the event underscores persistent risks in decentralized markets where automated bots distort price discovery and liquidity depth. One trader reported a $600,000 profit, illustrating both volatility and opportunity in low-volume environments. Experts urged DEX developers to implement circuit breakers and smart contract safeguards to prevent recurrence and maximize data transparency.

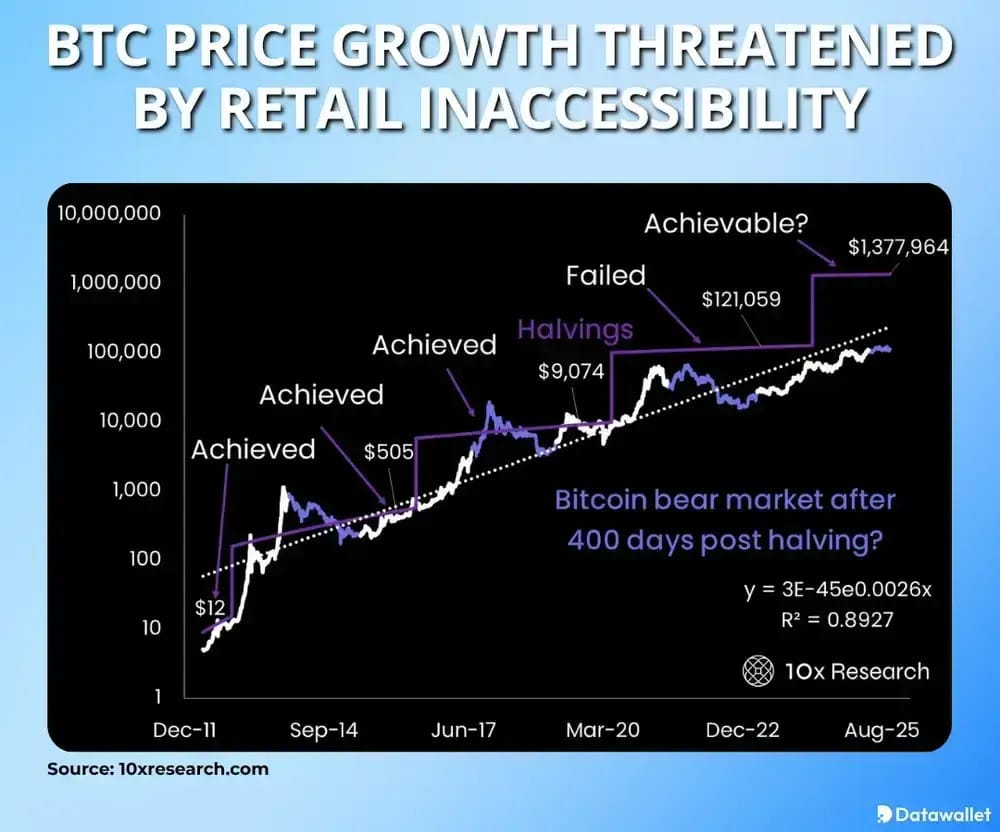

Data of the day

Bitcoin’s rising cost is deterring retail investors, raising concerns that the current bull market could lose momentum soon. A 10x Research report warned Bitcoin may have entered a maturity phase characterized by diminishing returns and slower expansion. Analysts said statistical comparisons to previous four-year cycles have become unreliable due to structural changes in global liquidity conditions.

The firm projected a potential cycle peak of $125,000, contrasting with models forecasting prices near $1 million. Researchers argued that Bitcoin’s limited accessibility could cap future demand and shorten extended market rallies. Institutional participation continues to rise, but analysts noted that sustained adoption depends on affordability and the strength of retail buying power.

More breaking news

Trump-backed Truth Social partnered with Cryptocom to launch “Truth Predict,” a federally compliant prediction market letting users trade event contracts using CRO tokens.

S&P Global gave Michael Saylor’s Strategy a B-minus junk rating, citing high Bitcoin concentration and weak liquidity despite maintaining a stable outlook.

Ethereum treasury firm ETHZilla sold $40 million in ETH to fund share buybacks under its $250 million repurchase plan amid discount-to-NAV trading.

Kalshi sued New York regulators after receiving a cease-and-desist, arguing federal preemption protects its CFTC-regulated prediction markets from state gambling laws.

The dYdX community will vote on using $462,000 from its insurance fund to compensate traders impacted by an eight-hour chain halt in October.

Cathie Wood’s Ark Invest bought $31 million of Block Inc. shares and added DraftKings stock ahead of its upcoming prediction market launch.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.