- Datawallet Daily

- Posts

- Crypto Trails Gold as Analysts Forecast a 2026 Catch-Up Rally

Crypto Trails Gold as Analysts Forecast a 2026 Catch-Up Rally

Newsletter Issue #705

GM and Happy New Year. Crypto trails gold and equities into 2026, with analysts predicting a delayed catch-up rally as whales pause buying and retail steps in across volatile markets.

Meanwhile, Lighter’s $675M airdrop ranks among crypto’s biggest, Trump memecoin wallets move $94M in USDC, and Coinbase warns that US stablecoin policy could hand China a digital dollar edge.

Here’s how the year opens across crypto. 🎆 👇

Crypto Trails Gold as Analysts Forecast a 2026 Catch-Up Rally

Santiment analysts said that crypto markets are bleeding toward 2026, even as gold and equities recover from November’s crash. Bitcoin has lagged sharply, underperforming traditional assets despite its dominant macro narrative during recent risk-off rotations.

Since November, gold is up 9%, the S&P 500 gained modestly, while Bitcoin fell roughly 20% to around $88,000. Santiment said this divergence leaves crypto primed for a delayed catch-up rally heading into 2026.

Santiment noted large Bitcoin holders paused accumulation in late 2025, while smaller wallets aggressively bought dips across volatility. Historically, bullish reversals emerge when whales accumulate as retail sells, shifting liquidity and sentiment back toward risk assets.

Onchain data from Nansen and traders suggest capital may already be rotating back into crypto from metals and equities. Active Bitcoin addresses jumped 5.51%, as analysts describe classic late-cycle positioning before a structural shift in market leadership.

Lighter Airdrop Ranks Among Crypto’s Largest Ten

Lighter, a decentralized perpetual futures exchange, distributed $675 million worth of LIT tokens to early users on Tuesday. Blockchain analytics firm Bubblemaps confirmed the airdrop size, placing it among the ten largest token distributions historically. CoinGecko data shows the event surpassed 1inch’s $671 million giveaway, ranking tenth by dollar value globally.

Post-airdrop data shows roughly 75% of recipients retained their tokens, while 7% increased exposure through open market purchases. Analysts tracking wallets said the holding behavior suggests expectations of further upside following the token generation event. However, critics flagged tokenomics concerns, noting 50% of total supply remains allocated to Lighter's teams and investors

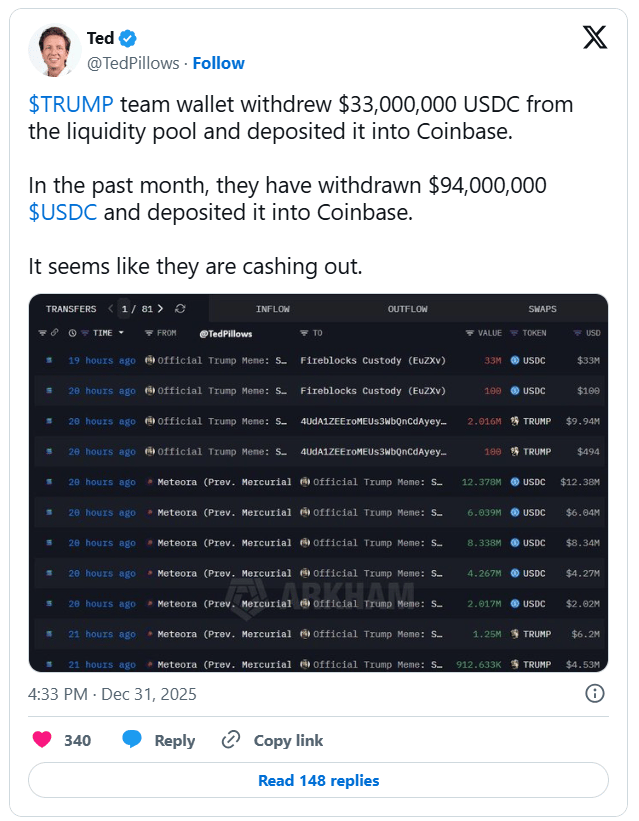

Trump Meme Coin Wallets Move $94 Million USDC

Wallets linked to the Official Trump meme coin team moved approximately $94 million in USDC from liquidity pools during December. Arkham data shows the transfers routed through Fireblocks before reaching wallets labeled as Coinbase-controlled infrastructure. Solana blockchain records confirm the withdrawals occurred steadily over several weeks rather than through single transactions.

The movements follow a sharp decline in TRUMP’s price, now below $5 after peaking above $75. Late buyers suffered losses as insiders reportedly generated over $320 million from fees and liquidity activity. Lawmakers have requested Treasury disclosures, increasing scrutiny surrounding politically branded crypto projects and affiliated onchain financial flows.

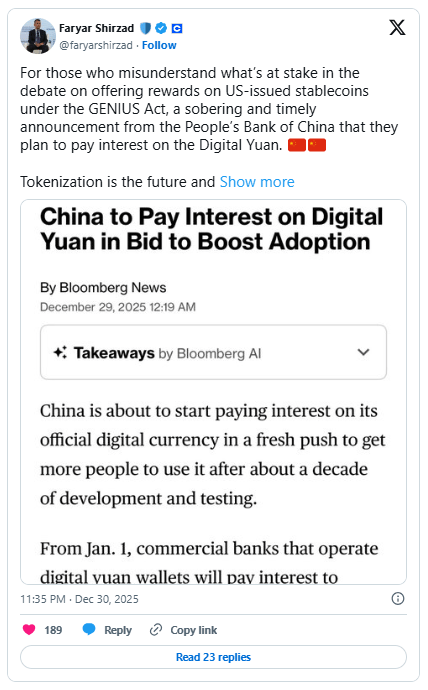

Coinbase Warns US Stablecoin Policy Favors China

Coinbase policy chief Faryar Shirzad warned US lawmakers that restricting stablecoin rewards could undermine dollar competitiveness globally. His comments followed China’s announcement allowing banks to pay interest on digital yuan holdings starting 2026. Shirzad argued yield incentives shape adoption outcomes as nations compete over digital settlement infrastructure leadership.

China’s central bank said interest-bearing e-CNY wallets aim to boost usage after years of limited consumer traction. By contrast, the GENIUS Act bars US stablecoin issuers from paying yield directly to holders. Coinbase and industry groups argue strict enforcement risks pushing users toward foreign stablecoins and central bank digital currencies.

Data of the day

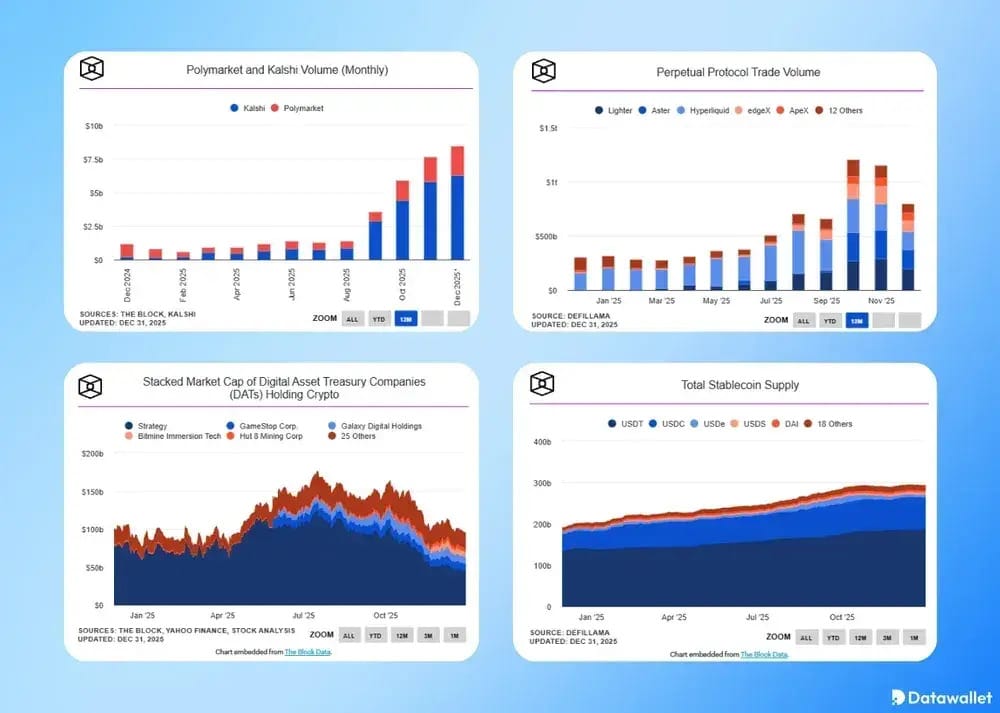

Crypto markets in 2025 showed structural change despite Bitcoin reaching new highs and many altcoins lagging prior peaks. Spot Bitcoin ETFs attracted $21.8 billion in net inflows, led by BlackRock’s IBIT with over 70% volume share. Stablecoin supply expanded toward $300 billion as payments firms and regulatory clarity accelerated mainstream adoption.

Prediction markets entered mainstream finance as Kalshi and Polymarket posted record volumes and major media integrations. Perpetual DEX activity rebounded sharply, with Hyperliquid and Lighter driving monthly volumes beyond $1 trillion. Meanwhile, crypto treasury companies surged then retraced, with aggregate DAT market capitalization falling 46% from yearly peaks.

More breaking news

Perpetuals decentralized exchanges handled $7.9 trillion in trading volume during 2025, as liquidity deepened, rivals gained traction, and onchain leverage scaled rapidly.

Bitwise filed with the SEC to launch 11 crypto strategy ETFs tracking assets like Tron, Hyperliquid, and Bittensor, signaling broader mainstream adoption.

NFT supply surged to 1.34 billion tokens in 2025 even as sales, average prices, and total market capitalization continued steep multi-year declines.

Spot Bitcoin ETFs attracted $355 million in inflows, ending a weeklong outflow streak and signaling resilient institutional demand despite thin holiday liquidity.

Ethereum transactions hit a record 2.2 million per day as average fees dropped to $0.17 following major upgrades improving scalability and gas efficiency.

Prenetics halted Bitcoin purchases after a market downturn, shifting focus to its fast-growing IM8 business while retaining 510 BTC as reserve assets.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.