- Datawallet Daily

- Posts

- CZ Proposes Wallet Fixes After $50 Million USDT Scam

CZ Proposes Wallet Fixes After $50 Million USDT Scam

Newsletter Issue #701

GM. CZ is calling for wallet-level safeguards after a $50 million USDT address poisoning scam exposed one of crypto’s most persistent phishing threats.

Meanwhile, Pudgy Penguins light up the Las Vegas Sphere, scammers impersonate Circle with a fake metals platform, and Bitcoin briefly wicks to $24,111 on Binance.

Here are the top crypto headlines from the past day. 👇

CZ Proposes Wallet Fixes After $50 Million USDT Scam

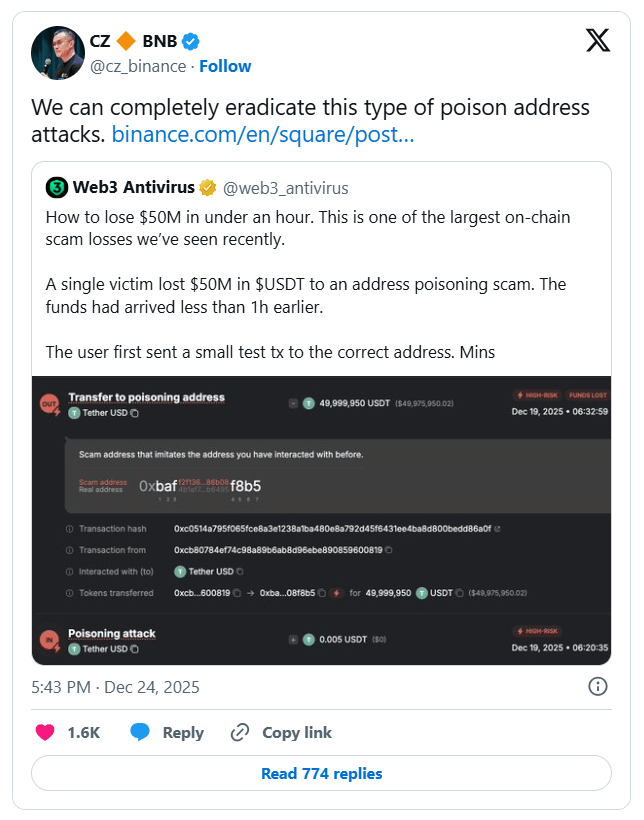

Binance co-founder Changpeng Zhao proposed new wallet-level defenses after an investor lost $50 million in USDT to an address poisoning scam, spotlighting one of crypto’s fastest-growing phishing threats. Zhao said simple checks could eradicate the tactic.

Address poisoning works by seeding wallets with tiny transactions, tricking users into copying fraudulent addresses from transaction histories and misdirecting transfers. Scam Sniffer data shows phishing hit 6,344 victims in November, losses accelerating after the $50 million incident.

CZ urged wallets to automatically flag or block known poison addresses, hide spam transactions entirely, and rely on blockchain queries and shared blacklists. Binance’s security team says its detection system has already identified roughly 15 million poisoned addresses.

Security firms rank phishing as crypto’s most damaging scam of 2024, exceeding $1 billion in stolen funds, as address poisoning replaces earlier drainer models. While recoveries are rare, pressure once forced a scammer to return $71 million.

Pudgy Penguins Wraps Las Vegas Sphere

Pudgy Penguins wrapped the Las Vegas Sphere after securing approval by promoting toys and merchandise rather than crypto. The Christmas activation debuted on Tuesday, following earlier rejection of Dogwifhat advertising despite its $700,000 community fundraising. Sphere representatives said guidelines permit brand campaigns when messaging avoids NFTs, tokens, and trading references.

Pudgy Penguins began physical retail expansion in 2023, achieving $10 million in toy sales within twelve months globally. Executives said Sphere talks started in early 2024 and required months of animation production coordination with partners. During the seven-day wrap, only characters and merchandise availability appeared across the exosphere screens.

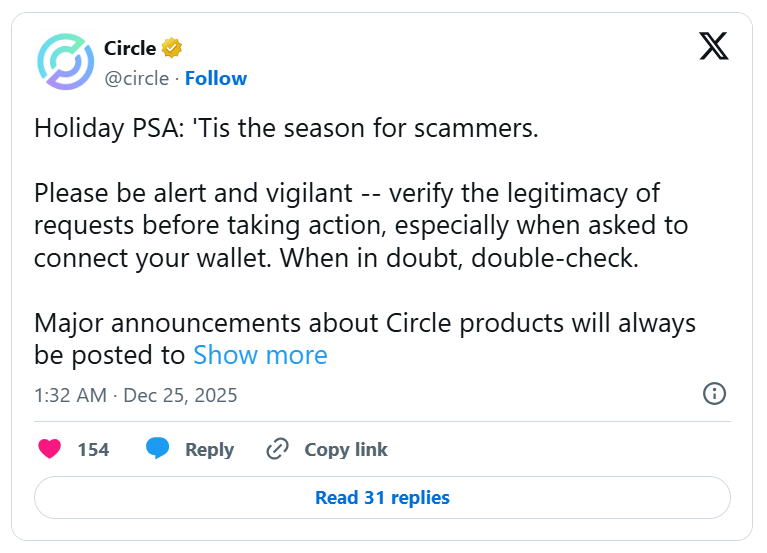

Fake Circle Metals Platform Exposed on X

A fake press release claimed Circle launched tokenized metals trading on Christmas Eve, company confirmed later publicly. The release promoted CircleMetals swaps between USDC and gold or silver tokens with rewards advertised widely. Investigators found no evidence of GLDC, SILC, or legitimate institutions backing the website whatsoever involved.

The site asked users to connect wallets, a common tactic enabling theft through malicious approvals quickly remotely. Circle warned users on X to verify requests and avoid interacting with unverified platforms online immediately. PR distributors removed the release after checks, underscoring heightened holiday scam risks for users globally.

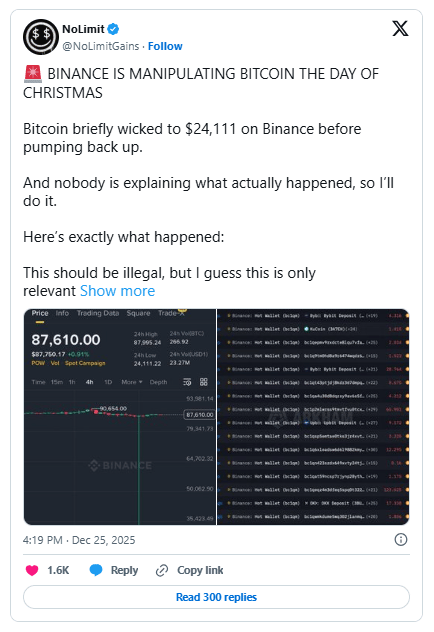

Bitcoin Price Wick Hits $24,111 on Binance Pair

Bitcoin briefly printed $24,111 on Binance’s BTC/USD1 pair before rebounding above $87,000 within seconds, exchange data showed. The anomaly appeared isolated to USD1, a new stablecoin with thinner order book liquidity conditions overnight. Other major pairs showed no disruption, indicating a microstructure event rather than market collapse broadly.

Thin liquidity allows single orders or liquidations to sweep bids, causing extreme temporary prints during quiet hours. New trading routes often lack market makers (even on trading giants like Binance), widening spreads until prices normalize quickly after execution resumes. Traders generally avoid thin pairs for execution, especially during low participation periods overnight, weekends, holidays.

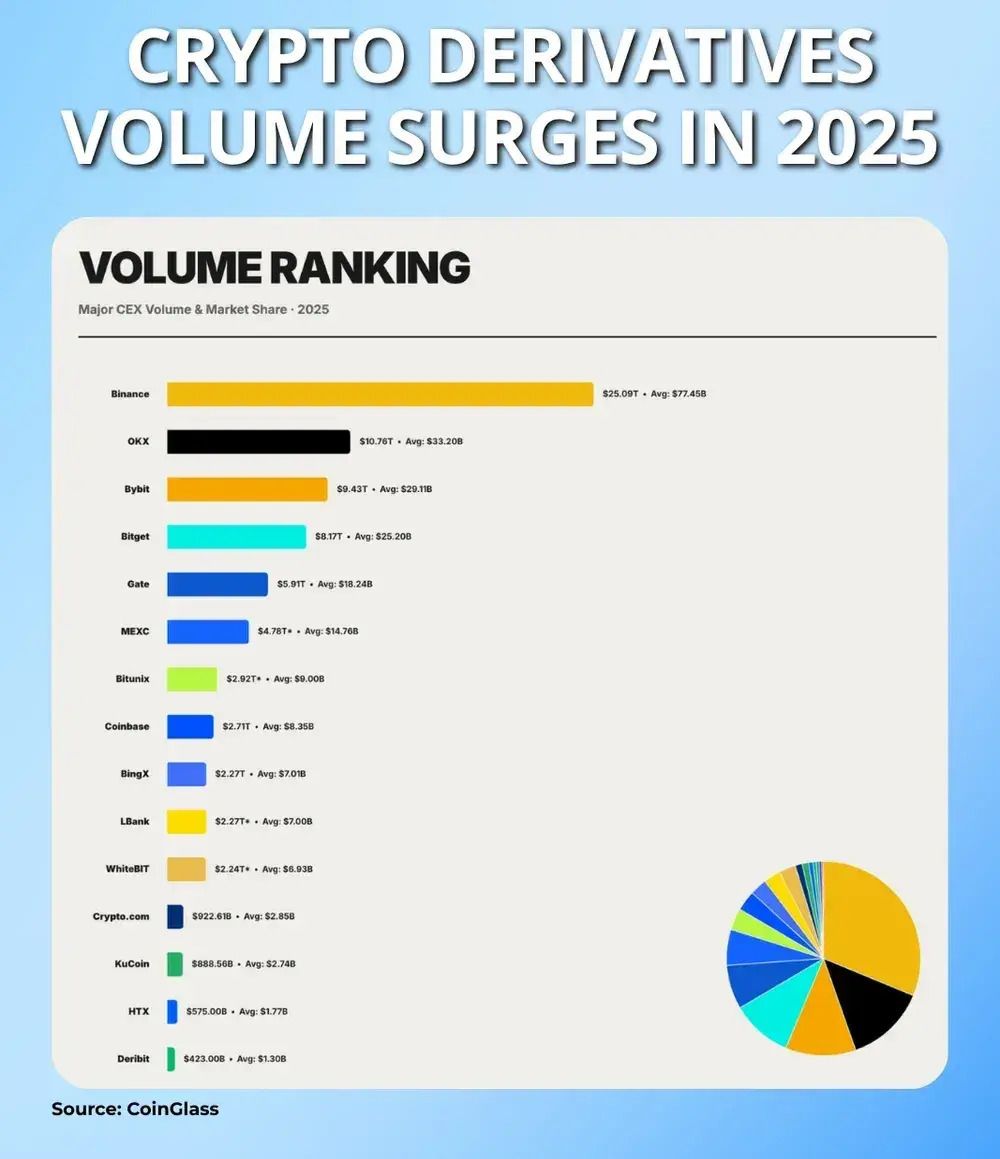

Data of the day

Global crypto derivatives volume reached $85.7 trillion in 2025, averaging $264.5 billion daily across major exchanges worldwide. Binance led with $25.09 trillion, about 29.3%, while OKX, Bybit, and Bitget followed closely throughout 2025. CME strengthened its role as institutional access expanded through ETFs, options, and compliant futures markets.

Derivatives activity shifted toward hedging and basis trades, increasing complexity and interconnected risk across venues, products, globally. Open interest swung sharply, falling near $87 billion before peaking at $235.9 billion during October volatility. CoinGlass estimated $150 billion liquidations in 2025, concentrated during October tariff driven selloffs worldwide briefly.

More breaking news

Crypto mergers and acquisitions hit a record $8.6 billion in 2025, led by Coinbase’s $2.9 billion Deribit purchase as deregulation fueled investor confidence.

Lawmakers face mounting pressure to finalize a comprehensive crypto bill before the 2026 midterms, with partisan divides, Trump’s conflicts, and time constraints complicating negotiations.

Samourai Wallet co-founder Keonne Rodriguez wrote from federal prison on Christmas Eve, as over 12,000 signatures back his growing pardon petition.

XRP’s US spot product surpassed $1.25 billion in assets, with ETFs absorbing supply while price action tightens between strong $1.85–$1.91 support and resistance.

Bitcoiners rallied behind Elon Musk’s forecast of double-digit US economic growth within 18 months, interpreting it as a bullish signal for BTC.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.