- Datawallet Daily

- Posts

- Do Kwon Sentenced to 15 Years Over Terra's Collapse

Do Kwon Sentenced to 15 Years Over Terra's Collapse

Newsletter Issue #692

GM. Terraform Labs founder Do Kwon was sentenced to 15 years in prison for his role in the $40 billion Terra collapse, marking crypto’s most consequential fraud ruling yet.

Crypto firms gain conditional US bank charters, Phantom adds Kalshi prediction markets to its wallet, and Tether’s $1.3 billion Juventus bid gets rejected.

Here are the stories opening crypto’s week. 👇

Do Kwon Sentenced to 15 Years Over Terra's Collapse

A US federal judge sentenced Terraform Labs founder Do Kwon to 15 years in prison on Wednesday for fraud tied to Terra’s collapse. The ruling closes a multiyear case stemming from a $40 billion wipeout across crypto markets worldwide.

Prosecutors argued Kwon misled investors about UST reserves and algorithmic stability, triggering cascading failures among lenders, funds, and exchanges. The judge cited eye-popping damage, victim statements, and systemic contagion when rejecting a lighter five-year request.

Terra’s May 2022 collapse erased over $40 billion, shattered retail savings, and accelerated the broader crypto credit unwind. Authorities said the implosion amplified stress at major firms, later ensnaring FTX and deepening market-wide distrust globally.

Do Kwon was arrested in Montenegro, extradited to New York, and pleaded guilty to conspiracy and wire fraud this summer. Sentencing on December 11 positions the case as a defining benchmark for crypto enforcement in the post-collapse era.

Crypto Firms Win Conditional US Bank Charters

Several major crypto firms received conditional approval from the OCC to operate federally regulated national trust banks. Approved applicants include Ripple, Circle, BitGo, Fidelity Digital Assets, and Paxos, pending final regulatory conditions. The approvals reflect a more supportive federal stance toward integrating digital asset custody within traditional banking oversight.

The charters would allow firms to custody client assets without accepting deposits or issuing loans like conventional banks. Circle plans to use its license to manage stablecoin reserves and serve institutional clients directly. Ripple’s approval could place its RLUSD stablecoin under combined state and federal supervision required by the GENIUS Act.

Phantom Integrates Kalshi Prediction Markets Inside Wallet

Crypto wallet Phantom has integrated Kalshi’s prediction markets, giving more than 20 million users in-app access. Users can trade event contracts covering politics, sports, crypto, and culture using Solana tokens or Phantom’s CASH stablecoin. The integration removes external accounts while delivering real-time odds, price updates, and automated settlement notifications.

Each market includes live community chat, allowing users to exchange insights as probabilities shift during active trading. Phantom CEO Brandon Millman said the goal is making prediction markets as intuitive as token swaps. The move follows similar wallet integrations by MetaMask and Trust Wallet amid rapid prediction market expansion.

Exor Rejects Tether’s $1.3 Billion Juventus Bid

Exor swiftly rejected Tether’s $1.3 billion offer to acquire Italian football club Juventus in full. The Agnelli family reaffirmed it has no intention of selling any Juventus shares, including its 65.4% controlling stake. Tether’s binding offer valued Juventus at €1.1 billion, representing a 21% premium over market price.

Tether holds over 10% of Juventus and gained a board seat earlier this year. CEO Paolo Ardoino framed the bid as a personal and strategic commitment to the club’s future growth. Despite Juventus requiring over €1 billion in capital injections recently, Exor signaled continued long-term ownership commitment.

Data of the day

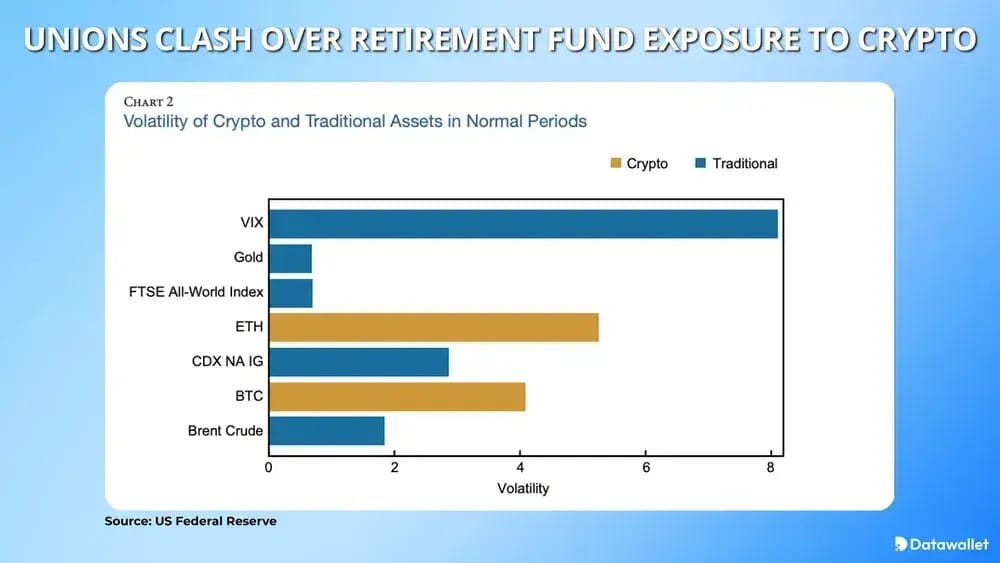

A dispute has emerged between crypto advocates and US trade unions over adding crypto to retirement accounts. Proposed legislation would allow 401(k) plans to gain crypto exposure, drawing criticism from labor organizations. The American Federation of Teachers warned lawmakers that volatility could threaten retirement security for millions of workers.

Crypto industry leaders countered that regulation would improve oversight while offering access to long-term growth assets. AFT President Randi Weingarten said pensions should avoid speculative investments like cryptocurrencies entirely. The AFL-CIO echoed similar concerns, urging Congress to block crypto inclusion within multi-trillion-dollar retirement systems.

More breaking news

Coinbase will reportedly debut its own prediction market and tokenized equities on December 17, entering a fast-growing yet heavily scrutinized sector.

Pakistan signed an MoU with Binance to explore tokenizing $2 billion in state assets while advancing plans for a national stablecoin.

A solo Bitcoin miner defied 1-in-30,000 odds to win a $282,000 block reward using Solo CKPool’s independent mining infrastructure.

Jump Crypto’s Firedancer client launched on Solana mainnet, boosting network resilience and targeting throughput of up to one million transactions per second.

Pyth Network launched a monthly token buyback using 33% of DAO treasury funds as its data products surpass $1 million annual recurring revenue.

YouTube now allows US creators to receive earnings in PayPal’s PYUSD stablecoin, reflecting Big Tech’s cautious adoption of regulated digital payment rails.

JPMorgan issued Galaxy’s first onchain commercial paper via a Solana-based USCP token, marking a milestone in blockchain-enabled institutional debt issuance.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.