- Datawallet Daily

- Posts

- Ethereum Activates Fusaka Upgrade on Mainnet

Ethereum Activates Fusaka Upgrade on Mainnet

Newsletter Issue #686

GM. Ethereum’s long-awaited Fusaka upgrade is live, kicking off its new twice-yearly fork cycle and unlocking major improvements to data capacity, validator efficiency, and rollup scaling.

Meanwhile, Solana Mobile confirmed its SKR token launch for January, Drift v3 boosted Solana trading speed tenfold, and Citadel caught heat for pushing DeFi regulation.

Upgrades, launches, and lobbying cap off the week. 👇

Ethereum Activates Fusaka Upgrade on Mainnet

Ethereum’s Fusaka upgrade went live at block 18,200,000, introducing new improvements to data capacity, validator efficiency, and network scaling. The update launches Ethereum’s twice-a-year hard-fork schedule, signaling a faster, more disciplined approach to protocol development.

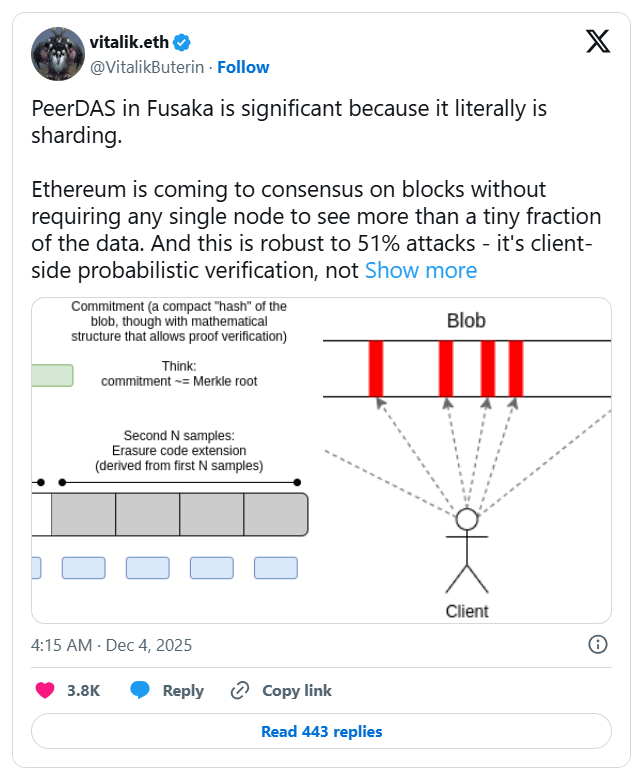

PeerDAS, the upgrade’s central feature, lets validators sample smaller data segments instead of downloading entire blobs, reducing bandwidth strain. Developers said this could expand blob capacity nearly eightfold and sharply lower Layer 2 rollup costs without affecting base-layer security.

Ethereum’s price climbed to $3,200, up 4.3% after activation, as trading volume rose from $28.2 billion to $32 billion. Analysts credited the move to “shark wallet” accumulation, describing it as renewed confidence in Ethereum’s scaling roadmap and settlement strength.

Fusaka also added Blob-Parameter-Only settings, refined blob-fee logic, and secp256r1 cryptography for device-native authentication. Researchers said these backend changes improve decentralization, increase zero-knowledge efficiency, and prepare the network for the next upgrade, Glamsterdam, scheduled for 2026.

Solana Mobile Confirms January Launch of SKR Token

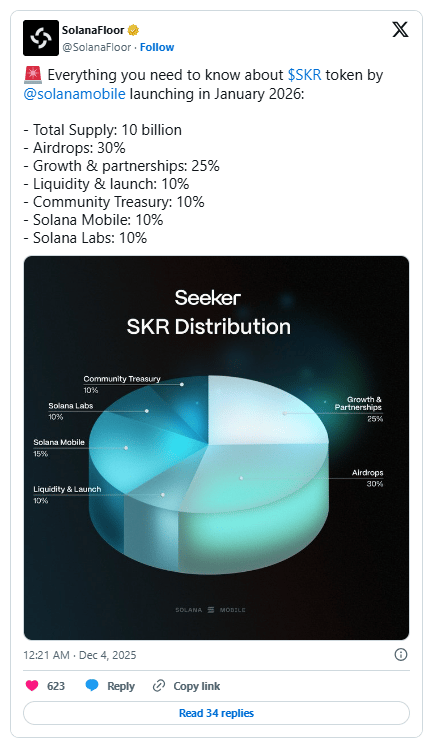

Solana Mobile said its native SKR token will officially launch in January 2026, expanding the Solana mobile ecosystem. The 10 billion supply token is designed to power ownership, incentives, governance, and user economics across the company’s Web3 handset network. About 30% of SKR’s total supply will unlock through an airdrop for Seeker owners and active decentralized app users.

Solana Mobile’s latest device, Seeker, has surpassed 150,000 preorders, with shipments already reaching buyers in more than 50 countries. The Android-based phone includes features like the Solana dApp Store, Seed Vault key storage, and a Genesis Token that enables early access rewards. Developers said additional details about SKR’s role will be shared during the Breakpoint 2025 conference in Abu Dhabi next week.

Solana Drift Debuts v3 to Boost Trading Speed Tenfold

Solana-based trading platform Drift has launched its v3 upgrade, delivering 10-times faster order execution and dramatically reduced slippage. Developers said roughly 85% of market orders now fill in under half a second, with slippage dropping near 0.02%. The new backend architecture aims to make decentralized trading feel as natural as centralized exchanges while improving efficiency and liquidity depth.

Drift v3 also adds a redesigned interface featuring clearer portfolio displays, faster price oracles, and streamlined lending and borrowing sections. Stop-loss and take-profit tools now update within a single Solana slot, further cutting transaction delays for users. Core contributor Cindy Leow said the upgrade sets a new standard for decentralized perpetuals performance on Solana’s high-throughput network.

Citadel Faces Backlash Over DeFi Regulation Push

Citadel Securities urged the SEC to regulate decentralized finance platforms that offer tokenized US equities, sparking widespread backlash. In a letter Tuesday, the firm argued DeFi trading platforms meet the legal definitions of exchanges or broker-dealers. Citadel claimed exempting such entities would create uneven oversight and contradict the technology-neutral approach of federal securities laws.

Crypto leaders and advocacy groups criticized Citadel’s stance as anti-innovation and harmful to open-source development. Blockchain Association CEO warned such regulation would drive developers offshore and undermine US competitiveness. Uniswap founder Hayden Adams called the comments “predictable,” accusing Citadel of protecting entrenched financial intermediaries against peer-to-peer technology.

Data of the day

CertiK’s new research warns the US GENIUS Act and Europe’s MiCA framework are fracturing global stablecoin liquidity pools. The US law imposes strict reserve rules and bans yield-bearing stablecoins while integrating issuers into the federal financial system. Europe’s MiCA similarly requires full redemption at par but limits reserves to EU-based banks, creating regional concentration risks.

CertiK said diverging regimes will fragment cross-border liquidity and complicate settlements for multinational crypto firms and financial institutions. Analysts warned the split could introduce arbitrage opportunities while weakening global stablecoin fungibility. US Treasury Secretary Scott Bessent has described the GENIUS Act as a deliberate policy to reinforce dollar liquidity and preserve global currency dominance.

More breaking news

Binance founder CZ announced PredictFun, a BNB Chain prediction market letting users earn yield on locked funds while wagers remain unresolved.

Austrian police arrested two Ukrainian suspects for killing a 21-year-old in Vienna after forcing him to surrender his cryptocurrency wallet passwords.

The Bitcoin Policy Institute urged President Trump to pardon Samourai Wallet developers, arguing their prosecution misapplied federal money-transmission laws to software.

Meta is reportedly considering cutting Reality Labs spending by 30% next year as enthusiasm for metaverse projects continues rapidly declining.

Ledger researchers revealed an unfixable chip flaw in Solana Seeker phones, allowing attackers to fully compromise devices and steal private keys.

Bitwise CIO Matt Hougan dismissed speculation that Strategy may sell Bitcoin, citing strong reserves, minimal debt, and no structural selling pressure.

Connecticut regulators ordered Robinhood, Cryptocom, and Kalshi to halt prediction markets, accusing them of conducting unlicensed online gambling and sports wagering.

BitMine purchased $150 million in Ethereum this week, reaffirming accumulation goals even as institutional ETH treasury buying considerably declined in November.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.