- Datawallet Daily

- Posts

- Ethereum Lifts Block Gas Limit to 60M Ahead of Fusaka

Ethereum Lifts Block Gas Limit to 60M Ahead of Fusaka

Newsletter Issue #681

GM. Ethereum lifted its block gas limit to 60M ahead of next week’s Fusaka upgrade, unlocking more base-layer capacity as the network gears up for higher throughput.

Meanwhile, Ripple’s RLUSD earned Abu Dhabi approval, the United Kingdom refined DeFi tax rules, and Australia pushed new licensing for crypto platforms.

Bigger blocks, bolder policy, and a busy week’s close. 👇

Ethereum Lifts Block Gas Limit to 60M Ahead of Fusaka

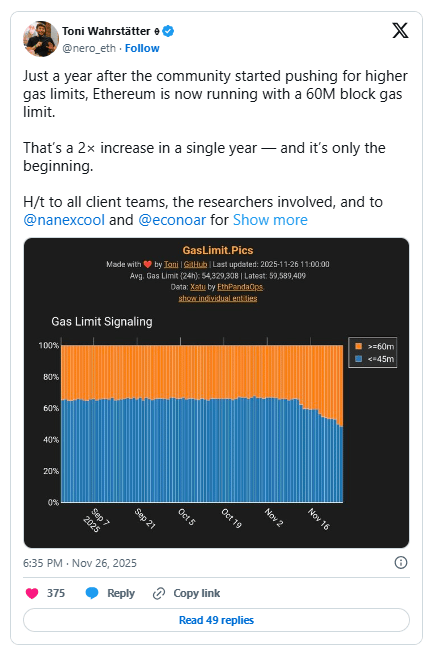

Ethereum raised its block gas limit from 45 million to 60 million on Monday after most validators signaled support for greater execution capacity. The adjustment capped a year-long campaign from developers and DeFi users pushing for broader throughput at Ethereum’s base layer.

Foundation researchers said the increase was enabled by safeguards like EIP-7623, improved client performance, and stable testnet results under heavier load. Analysts said the aligned upgrades allow Ethereum to pursue targeted layer-1 scaling without harming stability or block propagation.

Vitalik Buterin said the higher limit fits a shift toward selective optimization where future increases may coincide with steeper costs for heavy operations. He added that this approach preserves efficiency as blocks grow while still enabling expanded throughput across Ethereum’s primary network.

The move comes as rollups hit record throughput near 31,000 transactions per second and as the Fusaka upgrade approaches its Dec. 3 activation. Fusaka introduces PeerDAS, a redesigned data-availability system seen as essential for rollup scaling, alongside client updates and extra security controls.

Ripple's RLUSD Receives Approval Inside Abu Dhabi

Ripple secured ADGM approval for RLUSD, allowing regulated entities to use the stablecoin compliantly. The token was designated an Accepted Fiat Referenced Token under the jurisdiction’s strict supervisory framework. Ripple aims to expand regional operations by integrating RLUSD into institutional settlement flows across multiple corridors.

RLUSD supply recently surpassed one point two billion due to accelerating enterprise demand for regulated tokens. The asset operates under a New York trust charter requiring conservative reserves and transparent redemption processes. Several regional banks already use RLUSD within collateral workflows supporting improved cross border settlement efficiency.

UK Advances NGNL Tax Approach For Decentralized Finance

The UK proposed NGNL tax treatment to stop DeFi deposits from triggering artificial taxable disposals. Officials said current rules misrepresent routine protocol usage by creating gains without meaningful economic realization. The consultation suggests updated guidelines to align reporting obligations with genuine financial outcomes across decentralized markets.

Industry leaders welcomed the model because it matches operational mechanics of lending protocols and liquidity pools. Regulators confirmed gains would be taxed only once users ultimately realize increased asset value. HMRC plans continued engagement with developers and experts before finalizing legislative language for parliamentary consideration.

Australia Seeks Licensing Rules For Crypto Platforms

Australia introduced legislation requiring major digital asset platforms to obtain national financial service licenses. Policymakers intend to apply existing consumer protections to custody operations and trading services within the sector. Officials cited rising national crypto participation as justification for stronger oversight improving market integrity.

Licensed entities must implement risk controls, disclose asset management practices, and maintain dispute resolution mechanisms. Smaller platforms below defined custody and transaction thresholds would receive exemptions supporting innovation among early ventures. Authorities expect tokenization growth to accelerate once regulatory safeguards strengthen institutional confidence.

Data of the day

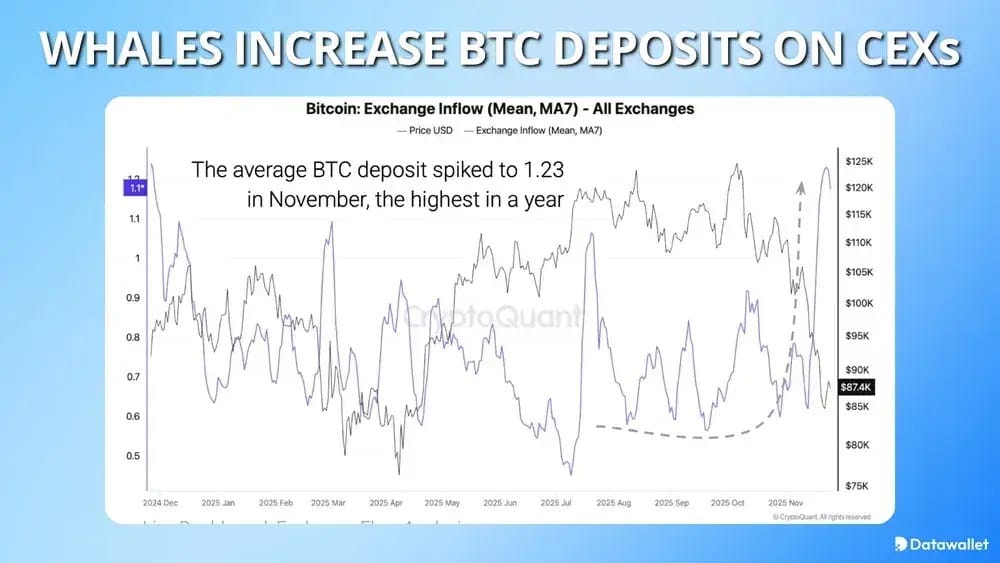

CryptoQuant reported a surge in large Bitcoin deposits following the recent price decline toward eighty thousand. Analysts said average deposit size rose significantly, implying whales transferred substantial holdings onto centralized venues. These inflows indicated heightened selling pressure as major traders continued reducing risk exposure across markets.

Binance recorded notable increases in average deposit amounts, showing large accounts repositioning after price weakness. Elevated inflows for ether and altcoins also suggested widespread caution among broader market participants. Exchange activity implies continued defensive sentiment as traders reassess positions during ongoing volatility and uncertainty.

More breaking news

Conor McGregor mocked Khabib Nurmagomedov’s NFT drop before ZachXBT clapped back, calling out McGregor’s own failed REAL token launch and deleted promo posts.

South Korea’s Upbit lost $36 million in a Solana wallet hack, paused services, moved assets to cold storage, and pledged full reimbursement to all customers.

SpaceX transferred $105 million in Bitcoin to new wallets, with analysts suggesting the transactions reflected internal treasury consolidation and routine wallet rotation.

Spot Solana ETFs logged $8.1 million in outflows after a 21-day inflow streak, signaling a rotation toward lower-risk altcoins amid volatile crypto markets.

Do Kwon urged a US judge to cap his prison sentence at five years, citing harsh detention conditions and major financial forfeitures already paid.

Securitize secured EU approval to run a regulated tokenized trading and settlement system on Avalanche, expanding its licensed infrastructure across both continents.

Justin Sun accused First Digital Trust of diverting TUSD reserves offshore and urged Hong Kong regulators to strengthen oversight of local trust firms.

Visa partnered with Aquanow to expand stablecoin settlements across Europe, the Middle East and Africa, promising faster, cheaper and fully compliant cross-border payments.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.