- Datawallet Daily

- Posts

- Ethereum’s Fusaka Upgrade Hits Final Testnet Milestone

Ethereum’s Fusaka Upgrade Hits Final Testnet Milestone

Newsletter Issue #660

GM. Ethereum’s Fusaka upgrade hit its final testnet, setting the stage for a December 3 mainnet launch with major scalability and security boosts.

Meanwhile, Polymarket readies its US relaunch, Western Union plans a Solana-based stablecoin, and World Liberty Financial is rewarding early USD1 users.

Here’s what’s advancing blockchains, compliance, and stablecoin adoption. 👇

Ethereum’s Fusaka Upgrade Hits Final Testnet Milestone

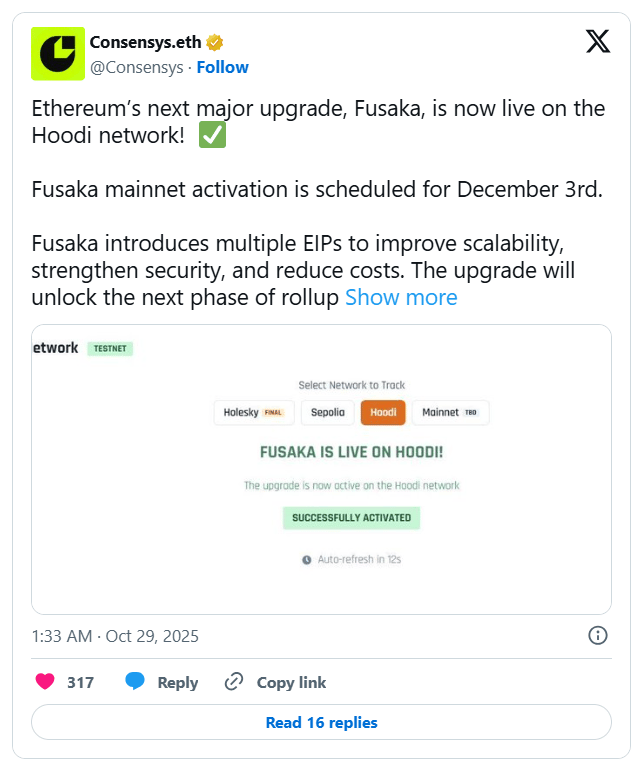

Ethereum’s upcoming hard fork, Fusaka, just activated on the Hoodi testnet, marking the final phase before mainnet deployment later this year. Core developers expect the network upgrade to launch on December 3, following a minimum 30-day post-test window.

The Fusaka release follows prior activations on the Holesky and Sepolia testnets, completing a month-long sequence of coordinated testing milestones. The Ethereum Foundation said Hoodi’s successful run will finalize readiness checks before the upgrade moves to the live network.

Fusaka introduces key scalability and security improvements, including expanded blob capacity, higher gas limits, and validator-level node protection mechanisms. Central to the release is EIP-7594, or PeerDAS, enabling validators to sample segmented data instead of entire blobs to boost efficiency.

A $2 million audit contest is underway to identify vulnerabilities before mainnet integration. The Fusaka hard fork follows April’s Pectra upgrade, as developers begin laying groundwork for the next major iteration, Glamsterdam, focused on faster block times and modular EVM optimization.

Polymarket Prepares For US Relaunch By Late November

Prediction platform Polymarket plans to reopen to American users by late November, according to Bloomberg sources. The return follows its 2022 enforcement settlement with US regulators and the acquisition of licensed exchange QCX. Executives said the relaunch establishes the firm as a federally compliant operator within the fast-growing event trading sector.

Polymarket’s expansion coincides with rising overlap between sports wagering and prediction markets across licensed digital exchanges. Recent partnerships with the National Hockey League highlight increasing institutional recognition of these hybrid financial instruments. The company also confirmed a forthcoming POLY token and airdrop to reward top participants after its domestic launch.

Western Union to Launch USDPT Stablecoin on Solana

Western Union will release a dollar-pegged stablecoin called USDPT through the Solana blockchain network in early 2026. The firm said Anchorage Digital Bank will issue the token, enabling users to send, receive, and store funds seamlessly. Executives added that the project aligns with Western Union’s broader mission to expand financial access through blockchain-based global remittance systems.

The payments company will also introduce a “Digital Asset Network” to support future tokenized financial products on Solana. Analysts said the move reflects growing institutional confidence in regulated stablecoins as efficient payment infrastructure. Western Union joins major firms like PayPal and JP Morgan pursuing digital currencies amid rapid global adoption and supportive policy changes.

World Liberty Financial To Reward Early USD1 Users

World Liberty Financial will distribute 8.4 million WLFI governance tokens to users who joined its USD1 stablecoin rewards program. The campaign, launched two months ago, incentivized users for trading USD1 pairs and maintaining token balances on partner exchanges. Company officials said the initiative strengthens community engagement and supports the platform’s long-term decentralization goals.

Eligible participants will receive WLFI tokens across Gate, KuCoin, MEXC, and other exchanges over the coming weeks. World Liberty said new features will expand earning options, including DeFi integrations and additional reward structures. The firm’s Trump-backed project is also exploring real-world asset tokenization and debit card services linked to its USD1 stablecoin.

Data of the day

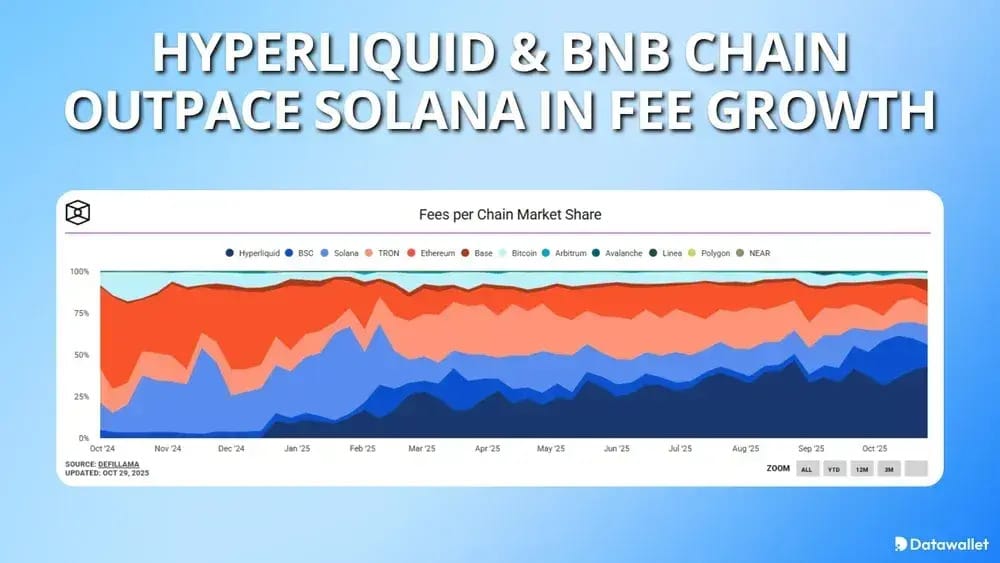

Layer 1 blockchain dynamics have shifted considerably as Hyperliquid and BNB Chain overtook Solana in total network fee generation. Earlier this year, Solana commanded more than half of market-wide fees but has since fallen below ten percent. Analysts attribute the reversal to derivatives-led activity on rival platforms and fading interest in Solana’s meme coin sector.

BNB Chain and Hyperliquid now collectively generate over sixty percent of major Layer 1 network fees worldwide. Experts say higher-value trading products and deeper exchange integrations helped redirect liquidity away from Solana’s retail-heavy environment. To regain ground, Solana will likely need new applications or another speculative cycle to restore user engagement and volume.

More breaking news

Georgia’s shadow ruler Bidzina Ivanishvili is accused of using state power to reclaim Bitcoin from a jailed advisor after missing a potential $21 billion fortune.

Zcash’s shielded supply hit 4.5 million ZEC as privacy coins adoption surged and infrastructure improved, reinforcing trust in its zero-knowledge transaction model.

21Shares filed for a Hyperliquid ETF tracking HYPE token performance, joining a wave of new crypto funds amid accelerated SEC registration activity.

Visa will expand support for four stablecoins across four blockchains to improve settlement, minting, and cross-border payments for banks and institutions.

Australia’s regulator reclassified stablecoins and wrapped tokens as financial products, requiring providers to obtain licenses under its updated digital asset guidance.

Tom Lee’s BitMine added $113 million in Ethereum, bringing its holdings above 3.3 million ETH worth $13.2 billion as accumulation continues.

Grayscale launched its Solana staking ETF on NYSE Arca with $103 million, joining Bitwise to expand institutional access to SOL staking exposure.

Tether confirmed full physical backing for its $2.1 billion gold cryptocurrency XAUT, as tokenized real-world asset demand and gold prices reached new highs.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.