- Datawallet Daily

- Posts

- Italy to Hike Bitcoin Capital Gains Tax From 26% to 42%

Italy to Hike Bitcoin Capital Gains Tax From 26% to 42%

Newsletter Issue #390

GM. We are back to the usual cadence: institutions expanding their crypto products, governments figuring out how to tax us more, DeFi protocols getting hacked and US election onchain bets surging.

Amidst all this, Bitcoin flirted with the $68,000 level, now up +6.5% about halfway through the month and nearly 60% since the start of 2024.

Here’s the complete breakdown of the most important news from the last 24 hours. 👇

Italy to Hike Bitcoin Capital Gains Tax From 26% to 42%

The Italian government has announced a plan to raise the tax rate on capital gains from Bitcoin and other crypto assets from 26% to 42%, representing a relative increase of 62%. The Deputy Minister of Economy disclosed this during a press conference on the 2025 budget, stating that the tax hike is part of a broader strategy to generate revenue to support families, businesses, and young people.

Italian taxpayers will now have to include crypto gains on their tax forms, including sales profits and staking rewards. This enormous tax hike continues Italy’s previous effort, where a 26% tax on crypto gains above €2,000 was introduced in 2023.

In addition to the new tax on crypto, the government is revising its web tax policy, removing revenue thresholds, and cracking down on crypto exchanges operating in Italy. These changes come in line with the upcoming regulations under the Markets in Crypto-Assets (MiCA) framework.

Radiant Capital Hacked for $51M on Arbitrum, BNB Smart Chain

Radiant Capital has suffered a $51 million hack, impacting its Ethereum Layer 2 Arbitrum instance and BNB Smart Chain deployments, according to Web3 security firm Ancilia. The attack involved a vulnerability in a Radiant smart contract's "transferFrom" function, allowing the exploiter to move tokens from users' wallets to a third-party address. Users must revoke all Radiant contract approvals.

The attack profile suggests an internal compromise of private keys, likely from phishing or an inside actor. The exploiter's wallet now holds over $32 million in Arbitrum-based assets and $18 million on BNB Smart Chain. This follows a $4.5 million flash loan attack Radiant suffered earlier this year, heightening concerns over the platform's security measures.

Robinhood Expands Into Bitcoin and Ethereum Futures Trading

Robinhood confirmed that it will offer Bitcoin and Ethereum futures soon as part of its broader push to attract seasoned traders through its trading app. The new futures offerings, expected to roll out in the coming months, will include Bitcoin and Ethereum contracts, micro futures, and Bitcoin Friday futures, the company revealed during its first-ever customer conference, HOOD Summit.

This is part of Robinhood's launch of its new desktop platform, Robinhood Legend, designed to provide active traders with sophisticated tools and real-time data. With low fees and a streamlined mobile interface, Robinhood aims to capture a growing market of retail crypto investors looking for advanced trading options such as crypto futures.

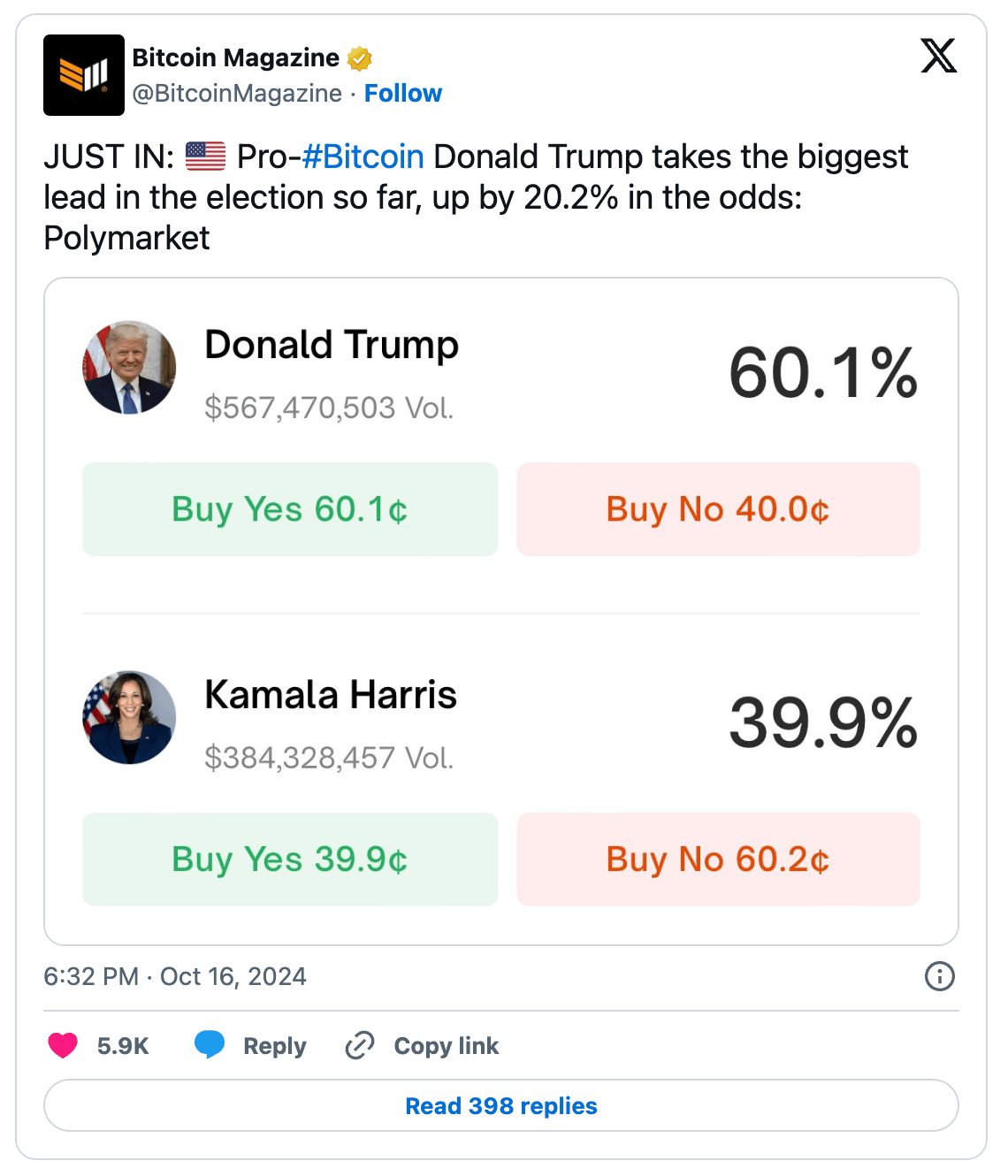

Trump’s Lead on Polymarket Grows to 20% Over Harris

Kraken has launched a new feature allowing customers to restake their already-staked ETH on Ethereum through the decentralized finance protocol EigenLayer. This restaking process provides additional yield opportunities by using already staked ETH for securing various decentralized platforms. Staked, Kraken's subsidiary, will act as the validator for these restaked tokens.

The total value locked in restaking tokens has surged by more than 3000% this year, reaching roughly $11 billion, according to DefiLlama, led by EigenLayer and Symbiotic. Kraken’s feature aims to lower barriers to entry for investors, with Mark Greenberg, Kraken’s global head of asset growth, noting that it opens up new yield-bearing opportunities for clients.

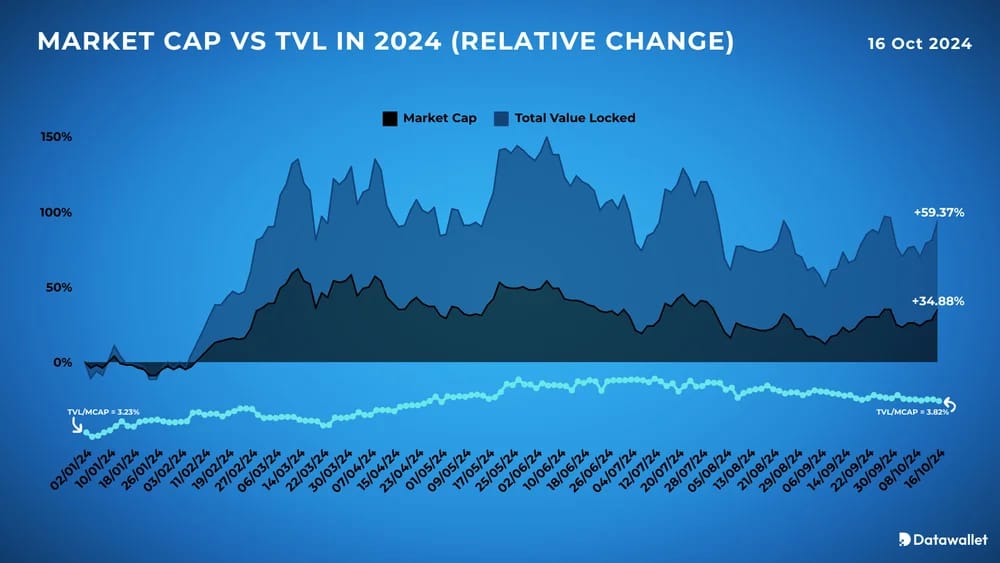

Data of the day

As of October 16, 2024, the total cryptocurrency market capitalization (market cap) has reached $2.31 trillion, marking a 34.88% increase from the $1.71 trillion recorded at the beginning of the year. In parallel, the total value locked (TVL) in decentralized finance protocols surged by 59.37%, rising from $53.75 billion to $88.24 billion.

Despite this significant growth in both metrics, TVL has consistently accounted for a modest share of the overall market cap, fluctuating between 3.15% and 4.22% throughout 2024. As of mid-October, the TVL-to-market cap ratio sits at 3.82%, reflecting that while DeFi continues to spread, its share of the broader crypto ecosystem remains relatively small.

More breaking news

Japanese investment firm Metaplanet updated its Bitcoin put options to a new $66,000 strike price while adding 107 BTC worth $6.7 million to its holdings.

Thailand's oldest bank will offer 24/7 stablecoin cross-border payments, reducing transaction costs in alliance with fintech company Lightnet.

Top crypto promoter Juan Tacuri was sentenced to 20 years in prison for his role in the Forcount Ponzi scheme that defrauded investors out of millions.

Hong Kong police arrested 27 suspects in a $46.3 million crypto fraud scheme that lured victims into investing in digital assets through romance scams.

Chainalysis is set to appear in court over a $650 million defamation suit, accused of falsely labeling YieldNodes as an investment scam.

Cosmos co-founder Jae Kwon said that North Korean agents contributed to the development of the network’s liquid staking module.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.