- Datawallet Daily

- Posts

- JPMorgan Launches $100 Million Tokenized Fund on Ethereum

JPMorgan Launches $100 Million Tokenized Fund on Ethereum

Newsletter Issue #693

GM. JPMorgan launched a $100 million tokenized money market fund on Ethereum, giving qualified investors onchain access to short-term debt yields via cash or USDC.

Strategy boosted its Bitcoin reserves by 10,645 BTC, Tom Lee’s BitMine added $320 million in Ethereum, and the UK Treasury moved to place crypto firms under full FCA oversight.

Here’s what happened to crypto in the past 24 hours. 👇

JPMorgan Launches $100 Million Tokenized Fund on Ethereum

JPMorgan Chase launched a tokenized money market fund on Ethereum, seeding the vehicle with $100 million of capital. The private fund, called MONY, opens to qualified investors Tuesday through the bank’s asset management and Morgan Money platform.

MONY offers onchain exposure to short term debt securities, paying daily yield while allowing subscriptions using cash or USDC. The fund requires $1 million minimum investments, targeting individuals with $5 million assets and institutions holding $25 million.

JPMorgan executives say client demand for tokenization is accelerating as regulatory clarity encourages banks to move traditional funds onchain. Tokenized money market funds benefit investors by keeping assets onchain while earning yield instead of idle stablecoin balances.

JPMorgan joins BlackRock, Goldman Sachs, and others experimenting with tokenized funds as real world asset markets reached $38 billion 2025. The Ethereum launch follows recent JPMorgan blockchain deals on Solana, underscoring a multi chain strategy for institutional finance.

Strategy Adds 10,645 Bitcoin, Treasury Reaches 671,268 BTC

Strategy acquired 10,645 Bitcoin between December 8 and December 14, spending $980.3 million at $92,098 per coin. The purchase was disclosed Monday through an SEC 8-K filing detailing funding sources and execution timing. The acquisition was financed using ongoing at-the-market equity and preferred stock issuance programs.

Following the purchase, Strategy now holds 671,268 BTC worth about $60 billion, representing more than 3% of total supply. The company’s average Bitcoin purchase price stands at $74,972, implying roughly $9.7 billion in unrealized gains. Executive Chairman Michael Saylor said the accumulation strategy remains unchanged despite market volatility and index scrutiny.

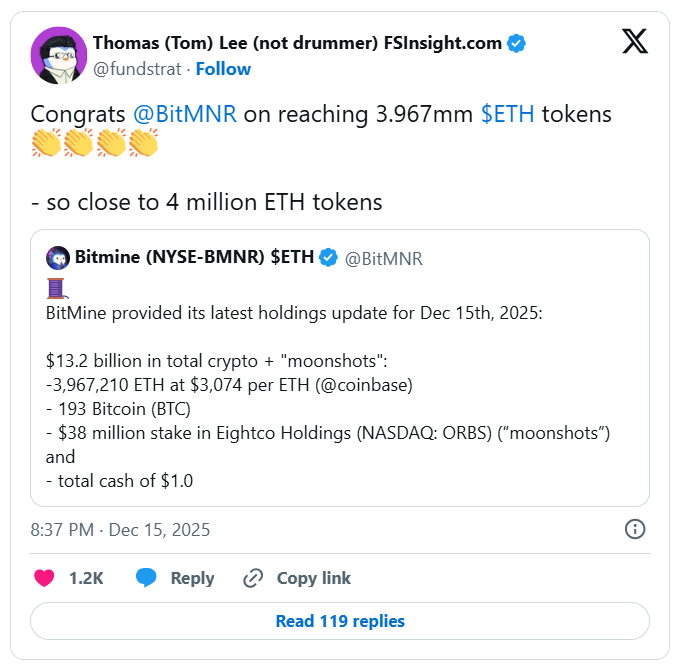

Tom Lee's BitMine Adds $320 Million in Ethereum to Treasury

BitMine Immersion Technologies purchased 102,259 ETH last week, spending approximately $320 million, according to a Monday company announcement. The acquisition brings BitMine’s total Ethereum holdings to 3,967,210 ETH, valued near $12.4 billion. The firm also holds 193 Bitcoin and $1 billion in cash reserves.

Chairman Tom Lee said the purchase reflects confidence that Ethereum has already bottomed following October market volatility. BitMine aims to accumulate 5% of Ethereum’s circulating supply while developing a proprietary staking infrastructure. Lee said the company could generate up to $400 million annually through staking revenue from its Ethereum treasury.

The United Kingdom Treasury Moves Crypto Firms Under FCA

The UK Treasury is drafting legislation to place crypto firms fully under Financial Conduct Authority oversight by late 2027. The proposal would expand regulation beyond anti-money laundering requirements to governance, disclosures, and consumer protection standards. Officials say the move addresses fraud risks as crypto integrates further into mainstream finance.

Currently, most UK crypto firms operate under limited AML registration without product-level supervision or investor safeguards. The new framework would regulate crypto services like traditional financial products within the FCA perimeter. Industry experts warn compliance costs will rise but clarity could strengthen long-term credibility.

Data of the day

Global crypto exchange-traded products recorded $864 million in net inflows last week, according to CoinShares data released Monday. This marked the third consecutive week of inflows, following $716 million added during the prior week. Analysts described investor sentiment as cautious but gradually improving.

United States funds led with $796 million in inflows, while Germany and Canada added $68.6 million and $26.8 million. Bitcoin ETFs attracted $522 million, while Ethereum products recorded $338 million in weekly inflows. CoinShares said reduced short Bitcoin outflows signal recovering market confidence.

More breaking news

Bitwise finalized the ticker and 0.67% fee for its Hyperliquid ETF, signaling imminent launch and giving it an edge over competitors.

Ondo Finance will launch tokenized US stock and ETF trading on Solana next year, enabling 24/7 settlement for global investors.

Bitcoin Bancorp will deploy 200 crypto ATMs across Texas in 2026, citing the state’s pro-innovation regulation and growing Bitcoin investment strategy.

Ripple partnered with Wormhole to bring its RLUSD stablecoin to Base and Optimism, expanding multichain adoption ahead of broader institutional rollout.

Visa launched a Stablecoins Advisory Practice to guide banks and fintechs in building onchain dollar products as stablecoin payments gain mainstream traction.

HTX secured Pakistan’s first No Objection Certificate for crypto licensing, marking a major milestone in the nation’s regulated digital asset expansion.

Vitalik Buterin urged X to adopt blockchain and zero-knowledge proofs, proposing verifiable transparency for algorithms shaping content visibility and user reach.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.