- Datawallet Daily

- Posts

- Kalshi Brings Tokenized Prediction Markets to Solana

Kalshi Brings Tokenized Prediction Markets to Solana

Newsletter Issue #684

GM. Kalshi launched tokenized prediction markets on Solana, linking regulated contracts with onchain liquidity and escalating its race with Polymarket for crypto-native traders.

Meanwhile, Bank of America lifted crypto allocation limits to 4%, Grayscale rolled out a Chainlink ETF, and a 2015 Ethereum whale staked its entire $120M balance.

Here are the top crypto headlines from the last 24 hours. 👇

Kalshi Brings Tokenized Prediction Markets to Solana

Kalshi launched tokenized versions of its event contracts on Solana, enabling onchain trading and merging previously separate liquidity pools into a single unified structure. Executives said the move allows the regulated platform to tap crypto capital directly while expanding distribution beyond its US user base.

The firm partnered with Solana protocols DFlow and Jupiter to route orders and connect its off-chain book with onchain liquidity more efficiently. Kalshi also introduced a $2 million grants program offering builder codes that reward developers who integrate its markets into applications or trading interfaces.

The expansion escalates competition with Polymarket, which recently secured CFTC approval to reenter the US after years offshore. Both firms reported record November volumes, with Kalshi hitting $5.8 billion and Polymarket exceeding $3.7 billion as prediction markets entered a rapid growth phase.

Kalshi’s broader crypto strategy follows a reported $1 billion raise that lifted its valuation to $11 billion and deepened institutional engagement. Leadership said builders will drive new categories across weather, economic indicators, and automated agents as the platform targets global positioning.

Bank of America Lifts Crypto Allocation Limits to 4%

Bank of America will permit clients to allocate up to 4% as demand for regulated crypto exposure increases. Executives said coverage of four spot Bitcoin ETFs begins January 5 to guide implementation across advised accounts. The shift ends a prior rule limiting more than fifteen thousand advisers from proactively recommending digital assets.

The strategy aligns the bank with peers offering standardized allocation bands as Bitcoin trades 10% lower year over year. Analysts note JPMorgan and Standard Chartered maintain long-term upside targets reaching $170,000 and $200,000 respectively. Vanguard recently allowed selected crypto products on its platform, signaling broader institutional acceptance of regulated asset access.

Grayscale Launches Chainlink ETF on NYSE Arca

Grayscale introduced its Chainlink ETF under ticker GLNK as tokenization and cross-chain connectivity attract expanding institutional attention. The fund converts a $17 million private trust holding LINK, one of the twenty-five largest cryptocurrencies globally. Executives said Chainlink provides essential oracle infrastructure linking blockchains to verifiable real-world data for smart contract execution.

Grayscale emphasized Chainlink’s role across public chains as decentralized finance scales toward wider adoption among governments and financial institutions. The launch follows recent ETFs for XRP, Dogecoin, and Solana as the firm broadens its regulated product suite. Grayscale also continues pursuing SEC approval for what could become the first exchange-traded product tracking Zcash.

Dormant Ethereum Whale Stakes Entire $120 Million Balance

A decade-old Ethereum ICO wallet holding 40,000 ETH moved its entire $120 million balance directly into staking. Historical records show the holder spent approximately $12,000 during Ethereum’s 2015 genesis sale to acquire the position. Analysts said the decision reinforces long-term conviction while contrasting recent sales from other early Ethereum participants.

Additional ICO wallets have liquidated huge sums, including one address reducing holdings to $9.3 million after steady selling. Another accumulated account sent 18,000 ETH to Bitstamp following earlier disposals exceeding 87,000 tokens at lower prices. Despite these movements, top addresses increased their ownership to 97.6% while the Beacon Deposit Contract reached 72.4 million ETH, per Arkham.

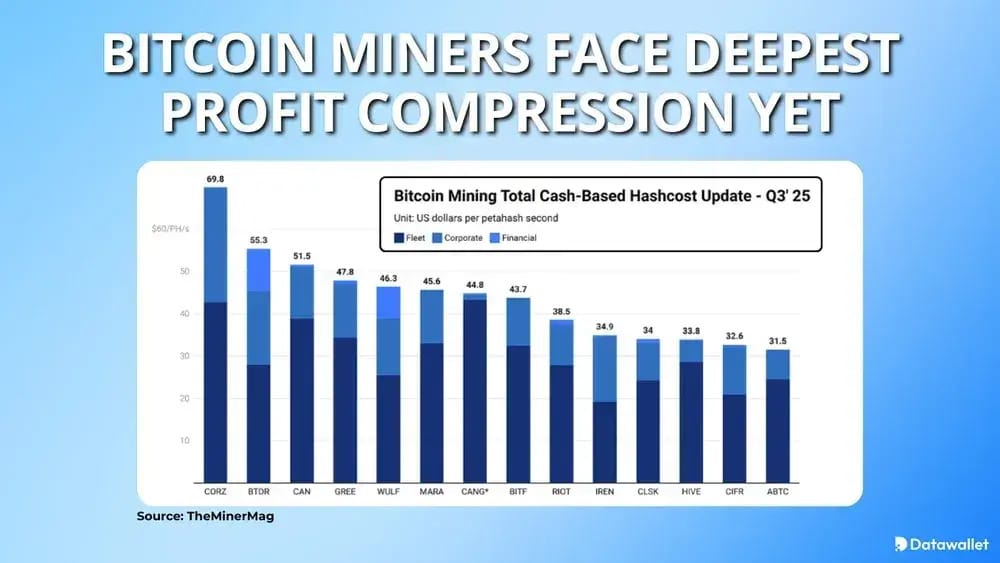

Data of the day

Hashprice has dropped to roughly $35 per PH/s daily after Bitcoin fell from $126,000 to below $80,000. Operators now face payback periods exceeding 1,000 days for new hardware while the halving approaches in approximately 850 days. Analysts said cost-per-hash efficiency reveals widening gaps between highly optimized miners and those nearing operational breakeven.

Large firms are reducing leverage as conditions worsen, with CleanSpark recently retiring its Bitcoin-backed credit facility. Equities across major miners continued sliding, including MARA falling 50%, CLSK down 37%, and RIOT off 32%. HIVE recorded the sharpest decline at 54% since October while macro pressures intensified sector-wide risk.

More breaking news

Coinbase said over half of its 12,716 law enforcement requests in 2025 came from outside the US, marking a 19% annual increase.

Ripple secured approval from Singapore’s MAS to expand regulated payment services using XRP and RLUSD under its Major Payment Institution license.

Sonnet shareholders approved a merger forming Hyperliquid Strategies, a $1 billion HYPE digital asset treasury backed by Paradigm and Galaxy Digital.

BlackRock CEO Larry Fink said tokenization is reshaping global market infrastructure, enabling instant settlement and broader access to investable assets.

Russia’s central bank is considering easing crypto restrictions to support cross-border payments and offset the impact of Western sanctions.

Yearn Finance recovered $2.4 million of stolen assets after an $9 million exploit caused by an unchecked arithmetic bug in legacy code.

Goldman Sachs will acquire Innovator Capital for $2 billion, adding a Bitcoin-linked ETF and expanding its steadily increasing ETF business.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.