- Datawallet Daily

- Posts

- Lighter Launches LIT Token With 50% Ecosystem Allocation

Lighter Launches LIT Token With 50% Ecosystem Allocation

Newsletter Issue #704

GM. Lighter has officially launched its LIT token, allocating half the supply to community incentives as the perps exchange expands its onchain trading ecosystem.

Meanwhile, Grayscale files for a spot Bittensor ETF, Metaplanet adds another $451 million in Bitcoin, and Unleash hackers move stolen ETH through Tornado Cash.

The past 24 hours in crypto. 👇

Lighter Launches LIT Token With 50% Ecosystem Allocation

Ethereum-based perps exchange Lighter unveiled its native LIT token on late Monday, formally detailing supply structure ahead of a long-awaited token generation event. The team framed LIT as an incentive-alignment layer for its progressively growing trading infrastructure.

Half of LIT’s total supply is allocated to the ecosystem, including an immediate airdrop covering two points seasons and future incentive programs. The remaining half goes to the team and investors under strict multi-year vesting schedules.

Lighter said protocol revenues and future product income will be transparent and trackable onchain, with proceeds funding growth initiatives and token buybacks. All value accrues to LIT holders, while infrastructure access tiers decentralize progressively through staking.

LIT began trading against USDC on early Tuesday near $2.34, below premarket levels, as Lighter builds momentum post-mainnet launch. The exchange logged $292.5 billion November volume and recently raised $68 million at a $1.5 billion valuation round.

Grayscale Files for Spot Bittensor (TAO) ETF

Grayscale filed with the SEC seeking to convert its Bittensor Trust into a spot exchange traded fund. The filing came weeks after Bittensor’s native token TAO completed its first halving event. The proposed ETF would offer direct exposure to TAO for US investors through NYSE Arca.

The trust, public since 2024, would trade under ticker GTAO with Coinbase Custody and BitGo listed custodians. Bittensor is a decentralized AI focused network rewarding contributors for computational resources supporting subnet performance. TAO traded near $222 after halving volatility, stabilizing following a brief post event price decline.

Metaplanet Buys $451 Million Bitcoin in Q4

Metaplanet acquired 4,279 Bitcoin during Q4, spending $451 million at an average price of $105,412. CEO Simon Gerovich disclosed the purchases on Tuesday as Bitcoin volatility pressured treasury focused equities globally. The acquisitions raised Metaplanet’s total holdings to 35,102 BTC accumulated since launching its treasury strategy.

At current prices near $87,400, the company’s Bitcoin treasury holdings are valued around $3.06 billion. Metaplanet’s shares fell across US and Tokyo listings amid broader crypto market weakness. Management said its credit facilities and collateral policies provide buffers against sharp Bitcoin drawdowns.

Unleash Hacker Launders $4 Million via Tornado

An attacker began laundering roughly 1,337 ETH through Tornado Cash after exploiting Unleash Protocol governance controls. The breach allowed unauthorized contract upgrades, enabling withdrawals totaling about $3.9 million in digital assets. Unleash paused operations on Tuesday while security firms traced funds bridged to Ethereum addresses.

Affected assets included USDC, WETH, WIP and IP derivatives, transferred in repeated 100 ETH increments. Analysts suspect a compromised multisig rather than a smart contract vulnerability caused the exploit. Unleash said Story Protocol infrastructure remained unaffected and promised updates following forensic review.

Data of the day

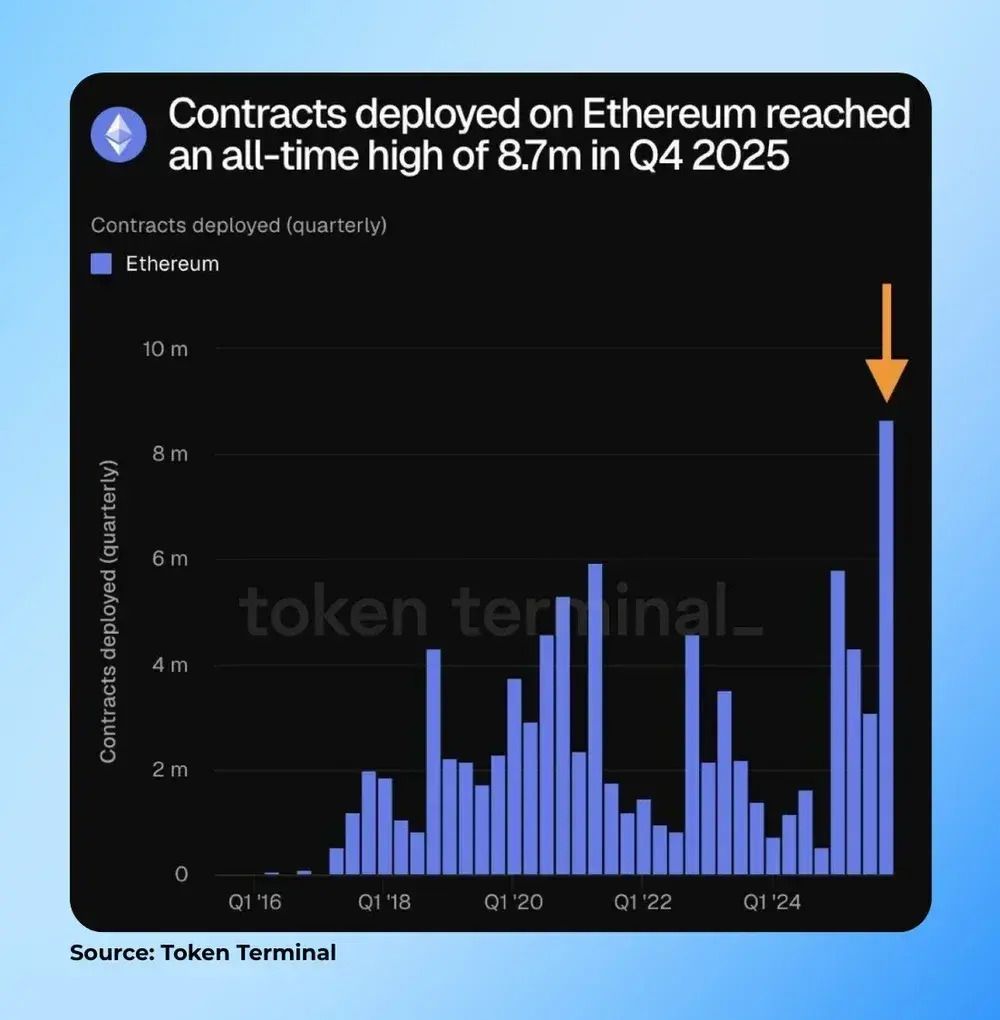

Ethereum recorded 8.7 million smart contract deployments during Q4 2025, according to Token Terminal data. The surge reversed slower activity earlier this year despite muted Ether price performance. Analysts attribute growth to stablecoins, infrastructure expansion and real world asset tokenization activity.

Ethereum hosts over half of $307 billion global stablecoin supply, led by USDt and USDC issuance. Researchers describe the network as the institutional standard for tokenized financial settlement. Contract growth often precedes higher transaction fees, validator revenue and broader onchain economic expansion.

More breaking news

Russia’s new draft bill would criminalize unregistered crypto mining with penalties up to five years in prison, forced labor, and heavy fines.

South Korea’s digital asset bill remains stalled as regulators clash over whether banks or tech firms should control stablecoin issuance under new rules.

Binance has suspended Visa and Mastercard withdrawals for Ukrainian users following Bifinity’s regulatory exit, though deposits and P2P trades remain active.

Hyperliquid Labs will unlock 1.2 million HYPE tokens worth $31 million for distribution on January 6 as part of its vesting plan.

A Canadian scammer posing as Coinbase support allegedly stole $2 million through social engineering, splurging on usernames, gambling, and luxury parties.

Winklevoss-backed Cypherpunk added $29 million in Zcash, lifting its holdings to nearly 2% of supply and reaffirming its long-term privacy asset strategy.

BlackRock’s tokenized fund BUIDL has paid $100 million in dividends, showcasing institutional-scale adoption of blockchain-based money market products and programmable finance.

Eclipse founder Neel Somani has stepped down as Executive Chairman to pursue machine learning research as the firm pivots toward a single flagship app.

Australia’s search engine age-verification rules took effect, requiring ID checks for users and sparking global debates on privacy, censorship, and digital sovereignty.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.