- Datawallet Daily

- Posts

- MetaMask Claim Site Sparks MASK Token Speculation

MetaMask Claim Site Sparks MASK Token Speculation

Newsletter Issue #658

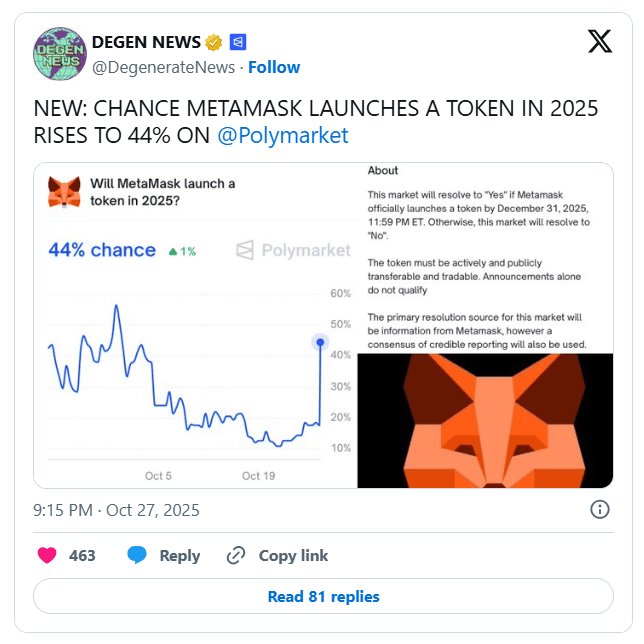

GM. A password-protected MetaMask claim site sent MASK token odds soaring on Polymarket as users speculate a long-awaited launch may finally be near.

Meanwhile, MegaETH raised $50M in minutes, Mt. Gox delayed repayments to 2026, and Trump’s sons’ Bitcoin firm added $160M to its reserves.

Here’s what’s behind speculation, fundraising, and family fortunes in crypto today. 👇

MetaMask Claim Site Sparks MASK Token Speculation

The odds of a MetaMask token launch surged to 44% on Polymarket after a supposed claim portal surfaced on Monday. The password-protected website, hosted on Vercel, appeared under the domain claim.metamask.io, prompting widespread community scrutiny and speculation.

MetaMask, developed by Consensys, has long hinted at a MASK token designed to advance decentralization within its Ethereum-based wallet ecosystem. Consensys CEO Joe Lubin recently said the token could “arrive sooner than expected,” describing it as a natural step toward community ownership.

Director of Product Christian Montoya told The Block that MetaMask is preparing a “loyalty program” distributing $30 million in rewards during its initial rollout. Users will earn points for swaps and referrals, with plans to expand eligibility across MetaMask Card and the new mUSD stablecoin.

Co-founder Dan Finlay earlier warned users against scam links, emphasizing any legitimate token or reward launch will appear only inside the wallet. The MASK token concept, first proposed in 2021 by MetaMask engineers, remains officially unconfirmed but increasingly expected.

MegaETH Raises $50 Million in Oversubscribed Token Sale

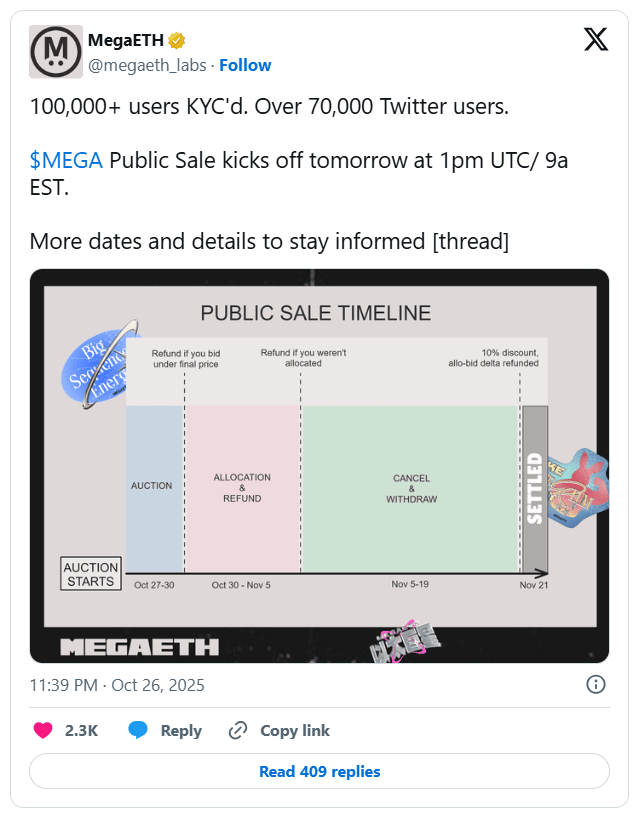

Ethereum startup MegaETH raised $50 million within minutes during its heavily oversubscribed MEGA token sale, as over 100,000 KYC'd to the event. The public auction, conducted Monday on Ethereum, sold 5% of total supply and capped out at its fundraising limit. Investors were able to lock tokens for twelve months in exchange for a 10% pricing discount.

According to company disclosures, bids exceeded three times available supply, pushing MegaETH’s implied valuation near $1 billion. Only verified accredited participants were allowed to join the sale, which used Tether’s USDT for payments. The project said MEGA will power ecosystem staking, sequencer rotation, and infrastructure incentives across its upcoming decentralized computing network.

Mt. Gox Delays Creditor Repayments to October 2026

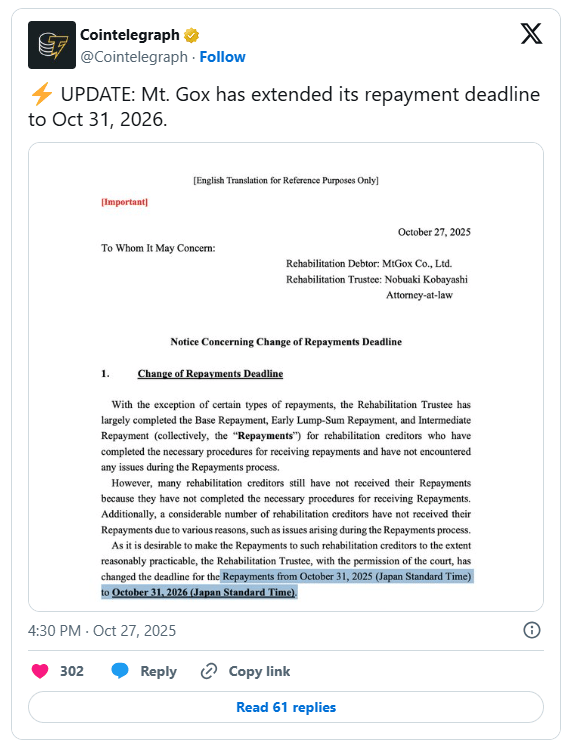

Bankrupt crypto exchange Mt. Gox has extended its creditor repayment deadline by one year to October 2026. The Tokyo-based trustee said it has nearly completed early and base repayments but continues facing verification and eligibility issues. The updated schedule marks the third formal postponement since the initial deadline set for October 2023.

Mt. Gox lost 850,000 Bitcoins in a 2014 hack that forced the exchange into bankruptcy proceedings. Trustees have gradually distributed recovered assets, repaying roughly 19,500 creditors with Bitcoin, Bitcoin Cash, and fiat currency since 2024. Blockchain data from Arkham shows the entity still holds about 34,689 BTC, currently valued around four billion dollars.

Trump Brothers’ Bitcoin Firm Buys $160 Million in BTC

American Bitcoin Corp, co-founded by Eric and Donald Trump Jr., added 1,414 Bitcoins worth over $160 million to its reserves. The Nasdaq-listed company’s holdings now total 3,865 BTC, positioning it among the world’s top twenty-five corporate treasuries. Executives said the accumulation reflects their strategy of combining in-house mining output with active market purchases.

Chairman Asher Genoot said integrated operations reduce acquisition costs compared to peers reliant solely on open-market buying. The BTC treasury company will also publish a new “Satoshis per Share” metric showing Bitcoin value per equity unit. Shares climbed 12% on Monday to $6.28, though they remain below the stock’s $8 debut price in September.

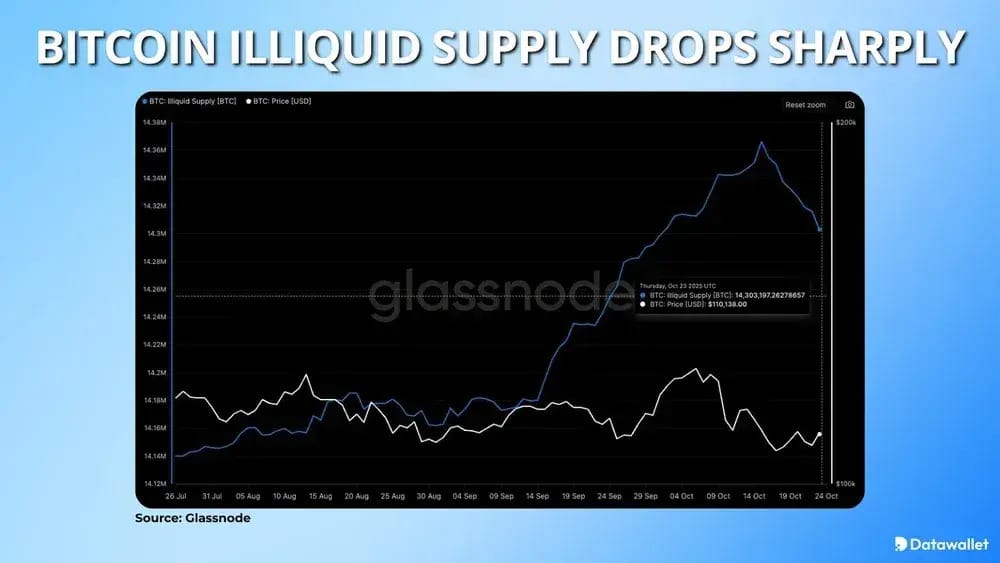

Data of the day

Roughly 62,000 Bitcoins, valued near seven billion dollars, exited long-term holder wallets since mid-October, Glassnode reported. The decline marks 2025’s first major reduction in illiquid supply, coinciding with Bitcoin’s retreat from its $125,000 record high. Analysts said increased token mobility may slow momentum by adding fresh supply to exchanges during weaker demand.

Glassnode noted smaller investors are selling while whales continue accumulating, signaling diverging sentiment across key wallet cohorts. Fidelity projected that by 2032, nearly 42% of total Bitcoin supply could remain permanently illiquid. Researchers said scarcity may eventually dominate market pricing as long-term holders tighten circulation despite cyclical price corrections and short-term outflows.

More breaking news

Tom Lee’s BitMine added $321 million in Ethereum, boosting its holdings to $13.8 billion as ETH rebounded and the firm’s shares climbed 5%.

Canada is reportedly preparing stablecoin rules for its federal budget, signaling alignment with US GENIUS Act reforms as global oversight intensifies.

Zcash surged past its 2021 high amid halving anticipation and renewed privacy coins narratives, though analysts warn speculative hype outweighs onchain fundamentals.

Japan’s fintech firm JPYC launched the nation’s first yen-backed stablecoin, targeting 10 trillion yen in issuance as demand for regulated digital money grows.

Michael Saylor's Strategy bought another 390 Bitcoin for $43 million, expanding its holdings to 640,808 BTC worth $74 billion, over 3% of total supply.

Anatoly Yakovenko argued Ethereum Layer 2 networks don’t truly inherit ETH’s security, calling them multisig-dependent systems vulnerable to exploitation.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.