- Datawallet Daily

- Posts

- Polymarket Blames Third-Party Flaw After User Hacks

Polymarket Blames Third-Party Flaw After User Hacks

Newsletter Issue #700

GM and Merry Christmas. Polymarket is investigating a third-party login flaw after users reported hacked accounts and drained balances, reviving security concerns from past exploits.

Meanwhile, the EU expands crypto tax reporting under DAC8, Hong Kong tightens digital asset licensing, and the Philippines blocks unregistered exchanges.

Here’s the latest in crypto as the holidays roll on. 🎄 👇

Polymarket Blames Third-Party Flaw After User Hacks

Polymarket confirmed this week that multiple user accounts were hacked through a vulnerability in a third-party authentication provider, after complaints surfaced on X and Reddit. Users reported drained balances following repeated login attempts, despite basic security precautions.

Affected users described receiving multiple login alerts before positions were force-closed and funds emptied, even without clicking phishing links or compromising devices. Several accounts reportedly used email-based wallet access designed for onboarding new crypto users to the prediction market.

Polymarket acknowledged the breach on its Discord, saying a third-party provider introduced the flaw and that the issue has been resolved. The company did not disclose the number of victims or value stolen in the incident.

The incident revives past concerns after similar third-party login exploits drained wallets in September 2024 and a later phishing campaign stole over $500,000. Polymarket said it will contact affected users and that no ongoing risk remains.

EU DAC8 Expands Crypto Tax Reporting

The European Union will implement DAC8 on Jan. 1, expanding tax reporting rules to crypto service providers. The directive requires exchanges and brokers to collect detailed user and transaction data for automatic sharing among EU tax authorities. Regulators say the change closes long standing reporting gaps that left crypto assets outside traditional financial transparency frameworks.

DAC8 operates separately from MiCA, focusing on tax enforcement rather than licensing, conduct, or consumer protection standards. Crypto firms must update reporting systems and due diligence controls by July 1 to meet compliance requirements. Authorities can coordinate cross border enforcement, including asset freezes or seizures, when unpaid taxes or evasion are detected.

Hong Kong Advances Crypto Licensing Regime

Hong Kong regulators will legislate new licensing requirements for crypto dealing and custody firms following completed public consultations. The framework requires firms offering virtual asset trading or custody services to obtain regulatory approval before operating locally. Officials say the move strengthens oversight as crypto activity expands within the city’s regulated financial system.

The initiative builds on earlier reforms, including the Stablecoin Ordinance and mandatory exchange licensing introduced after 2020. Regulators say the combined framework aims to support tokenization, stablecoins, and digital asset services under consistent supervision. Authorities argue clear licensing rules reinforce Hong Kong’s role as a trusted gateway between global capital and digital markets.

Philippines Blocks Unlicensed Crypto Platforms

Internet providers in the Philippines have begun blocking major crypto exchanges as regulators enforce local licensing requirements. Users reported losing access to Coinbase and Gemini after orders issued by the National Telecommunications Commission. The action follows central bank findings that dozens of platforms were operating without authorization.

Officials say the policy reflects a shift from tolerance toward strict territorial enforcement of crypto market access rules. Similar measures previously targeted Binance after a compliance deadline expired in early 2024. Regulators say licensed platforms may continue operating while unregistered exchanges face technical and application level restrictions.

Data of the day

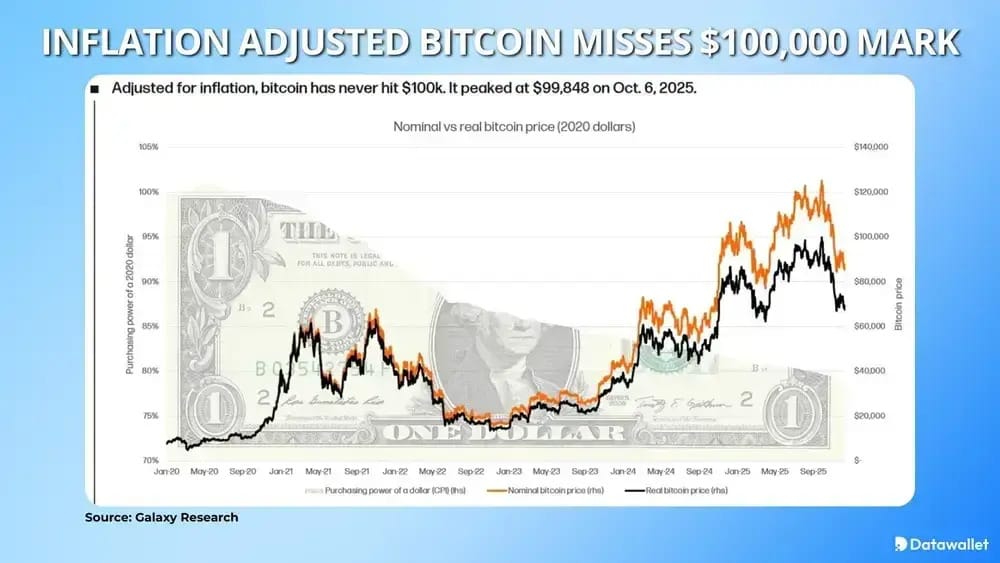

Bitcoin’s $126,000 record high falls below $100,000 when adjusted for inflation using 2020 purchasing power. Galaxy Research calculated the inflation adjusted peak at $99,848 based on cumulative Consumer Price Index changes. The analysis highlights how nominal price milestones differ from real value comparisons over time.

US inflation has reduced dollar purchasing power by roughly 20% since 2020, according to federal data. Rising prices and a weakening dollar have fueled interest in assets viewed as inflation hedges. Analysts say real value metrics provide additional context when assessing long term crypto market performance.

More breaking news

Spot Bitcoin and Ether ETFs saw over $280 million in outflows this week, as investors de-risked portfolios and locked profits ahead of thin holiday liquidity.

Crypto-linked stocks ended 2025 with stark divergence, as speculative early-year winners faded while fundamentally stronger firms proved more resilient heading into 2026.

The SEC charged seven entities in a $14 million crypto fraud that used fake trading platforms and social media chatrooms to lure investors.

Aave founder Stani Kulechov faces criticism after a $10 million AAVE purchase allegedly boosted his voting power ahead of a contentious governance vote.

JPMorgan’s potential crypto trading launch could expand institutional adoption, with analysts saying Coinbase, Bullish, and Galaxy stand to gain from deeper liquidity.

Trend Research purchased 46,379 ETH and plans another $1 billion in accumulation, as smaller treasury firms sell Ether to cover debt obligations.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.