- Datawallet Daily

- Posts

- Solana Mobile Airdrops SKR Token to Seeker Phone Owners

Solana Mobile Airdrops SKR Token to Seeker Phone Owners

Newsletter Issue #720

GM. Solana Mobile airdropped its SKR token to 100,000 Seeker phone owners, kicking off a community-owned mobile economy with 30% of the total supply allocated to users and developers.

Meanwhile, Ondo Finance deployed over 200 tokenized stocks on Solana, Donald Trump backed the crypto market structure bill at Davos, and Caroline Ellison was released from federal custody.

Here are the details on mobile incentives, tokenized equities, and Davos diplomacy. 👇

Solana Mobile Airdrops SKR Token to Seeker Phone Owners

Solana Mobile unleashed its native SKR token airdrop to over 100,000 Seeker phone owners and verified decentralized application developers. This strategic distribution establishes a community-owned mobile economy where active participants govern the underlying hardware network.

The airdrop campaign commenced on 20 January 2026 across the global Solana ecosystem to coincide with the Seeker Season 2 rewards initiative. Shipments of the new Android devices reached users in 50 countries, facilitating immediate on-chain participation.

Solana Mobile enacted this asset launch to incentivize network loyalty and fund developmental focus areas like gaming, payments, and decentralized physical infrastructure. By allocating 30% of the 10 billion supply, the project secures long-term alignment with users.

Recipients must utilize the built-in Seed Vault wallet to claim their stake before the 90 day window expires into the pool. Staking these tokens activates a linear inflation schedule that rewards early adopters through programmatic payouts every 48 hours.

Ondo Finance Deploys 200+ Tokenized Stocks On Solana

Ondo Finance expanded its tokenized equities platform to the Solana blockchain this Wednesday morning. The move introduces over 200 digital versions of US stocks and ETFs to the network for global investors. By leveraging Solana's high speed infrastructure, the firm aims to improve liquidity depth for real world assets that were previously limited to Ethereum.

These specific tokens provide 24/7 trading access for non US participants through regulated broker dealer custody. The rollout broadens the available asset catalog to include major technology growth stocks and broad market index funds. President Ian De Bode noted that this deployment establishes Ondo as the largest issuer of tokenized securities on the Solana ecosystem.

Trump Backs Market Structure Bill During Davos Speech

President Donald Trump publicly endorsed the crypto market structure bill during his Wednesday speech in Davos. He told world leaders that he hopes to sign the legislation very soon to unlock new pathways for financial freedom. This vocal support puts additional pressure on the Senate Banking Committee to finalize a deal following last week's sudden markup delay.

The White House also criticized Coinbase for withdrawing its support over disputed language regarding stablecoin reward limits. Executive Director Patrick Witt argued that fumbling this legislative opportunity now could lead to much more punitive future regulations. Meanwhile, industry executives remain at the table in Switzerland to negotiate a win-win scenario with traditional banking representatives.

Caroline Ellison Set For Release From Federal Custody

Former Alameda Research executive Caroline Ellison is scheduled for release from federal custody this Wednesday. She has been serving a 2 year sentence in a New York halfway house following her cooperation in the FTX fraud trial. The Federal Bureau of Prisons confirmed her transition out of community confinement after she provided critical testimony against Sam Bankman-Fried.

Ellison previously pleaded guilty to multiple conspiracy charges related to the 2022 collapse of the crypto exchange. Her cooperation helped jurors convict her former partner of stealing roughly $8 billion from unsuspecting global customers. While Ellison regains her freedom, the SEC is still pursuing a lifetime ban to prevent her from leading any public companies.

Data of the day

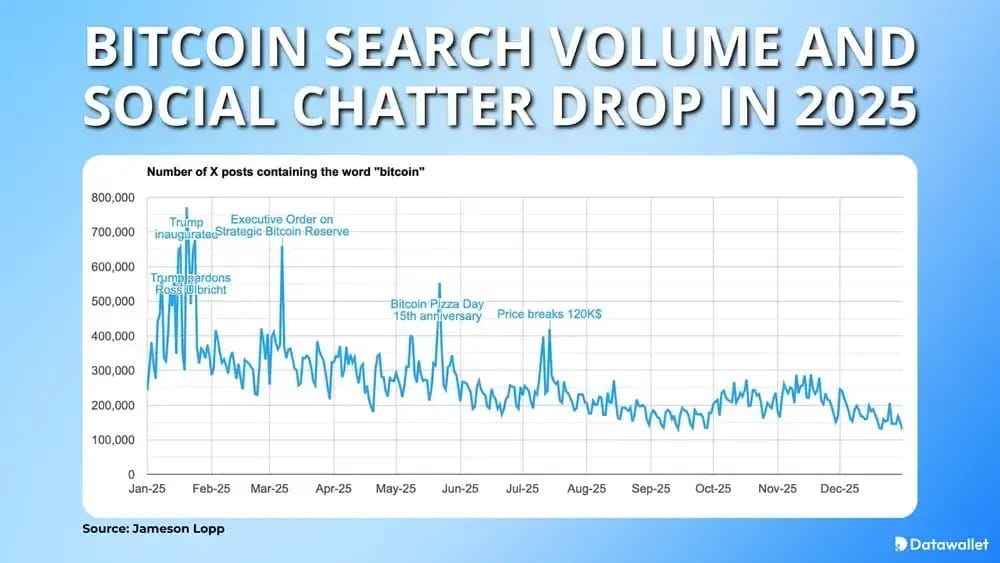

Online interest in Bitcoin declined substantially throughout 2025 despite the asset reaching new all time price highs. Google Trends data shows that global search volume fell 32% as retail participants shifted their attention to other sectors. This downward trend in public engagement suggests that institutional players rather than individual traders now drive the majority of market movements.

Social media chatter on the X platform also cooled as the number of Bitcoin related posts dropped to 96 million. High profile advocates like Michael Saylor remained active, but general sentiment in early 2026 remains notably bearish or fearful. Analysts monitor this divergence between rising prices and falling social interest to gauge the health of the current institutional cycle.

More breaking news

Hong Kong will grant its first stablecoin licenses in the first quarter of 2026 to foster a sustainable and responsible digital finance ecosystem.

Bitcoin whales and sharks accumulated $3.21 billion in assets over nine days, creating a bullish divergence as retail investors sold their holdings.

Solana launchpad Bags saw daily fees surge 16,000% to $100,000 on January 16, fueled by the viral popularity of Anthropic’s Claude Code tool.

Steak 'n Shake will launch a Bitcoin bonus program for hourly employees on March 1, offering $0.21 per hour worked through Fold.

The Winklevoss twins donated $1.2 million in Zcash to Shielded Labs to fund core protocol improvements and improve long-term network sustainability.

Bitpanda is set to launch trading for 10,000 stocks and ETFs on January 29, charging a flat €1 fee per transaction for users.

The Solana Policy Institute issued an open letter calling for stronger legal protections for software developers following the conviction of Roman Storm.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

1