- Datawallet Daily

- Posts

- StableChain Launches Mainnet With USDT as Gas Token

StableChain Launches Mainnet With USDT as Gas Token

Newsletter Issue #688

GM. StableChain, a Bitfinex-backed Layer 1 using Tether’s USDT for gas, launched with $2 billion in pre-deposits and a new governance token.

BlackRock advances staking ETFs, Vitalik explores Ethereum gas futures, and Coinbase reopens Indian access after a two-year regulatory freeze.

Here are the stories guiding crypto’s week. 👇

StableChain Launches Mainnet With USDT as Gas Token

Stable, a Bitfinex-backed Layer 1 blockchain using Tether’s USDT as its gas token, launched its mainnet and native STABLE token on Monday. The debut also introduced the Stable Foundation, an independent entity responsible for grants, governance, and ecosystem development.

The Ethereum-compatible network employs a delegated proof-of-stake model called StableBFT and claims over $2 billion in pre-deposits from 24,000 wallets. Its STABLE token will govern validator selection, network upgrades, and treasury allocations while all transaction fees settle directly in USDT.

Stable raised $28 million in seed funding led by Bitfinex and Hack VC, with advisors including Tether CEO Paolo Ardoino and Anchorage CEO Nathan Macauley. Institutional partners such as PayPal, Anchorage Digital, and Standard Chartered’s Libeara are expected to integrate the new chain’s payment and settlement rails.

CEO Brian Mehler said the project aims to establish “a truly onchain economy” linking stablecoin payments across retail and enterprise systems. The network’s fixed 100 billion-token supply includes 10% for genesis distribution and 40% for developer grants and partnerships.

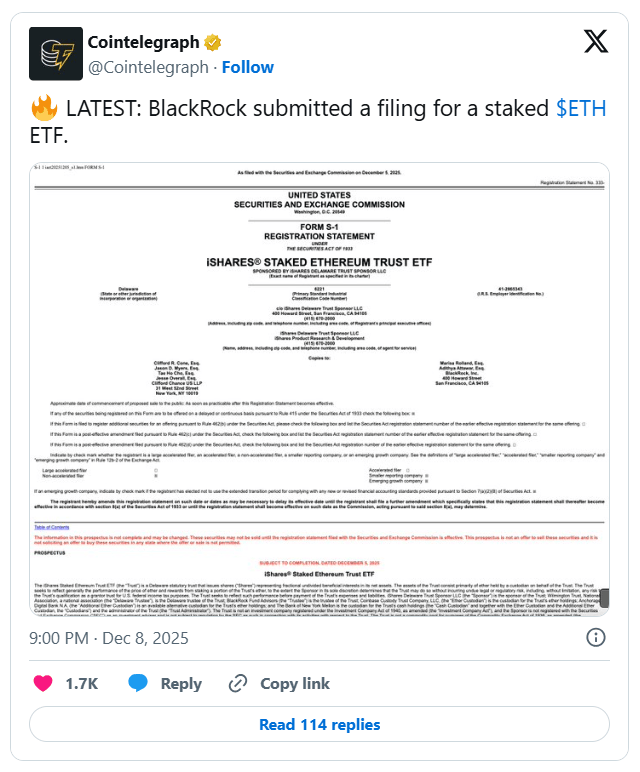

BlackRock Files for Staked Ethereum ETF in the US

BlackRock has filed with the SEC to launch a staked Ethereum exchange-traded fund named the iShares Staked Ethereum Trust. The filing seeks to reflect both ETH price performance and staking rewards, while maintaining compliance under US grantor trust taxation. It follows earlier registration in Delaware and builds on July’s Nasdaq proposal to include staking in its existing Ethereum ETF.

The iShares Ethereum Trust ETF, trading under ETHA, currently manages roughly $17 billion in assets, making it the largest of its kind. BlackRock’s new filing arrives as multiple issuers expand staking options, including Fidelity and Grayscale, amid a friendlier US regulatory climate. The move positions BlackRock to compete in the growing staked asset ETF market projected to exceed $25 billion next year.

Vitalik Buterin Floats Ethereum Gas Futures Market

Ethereum co-founder Vitalik Buterin proposed a trustless gas futures market allowing users to hedge transaction fees over time. The idea would enable participants to pre-purchase gas at set intervals, stabilizing costs amid fluctuating network demand. Buterin said such markets could create clearer pricing signals for developers and everyday users planning long-term Ethereum activity.

Critics including Flashbots strategist Hasu questioned feasibility, citing the lack of natural short positions and limited liquidity depth. Buterin responded by suggesting protocol-level participation to balance sides, but other researchers said Ethereum’s burn mechanism complicates that model. The proposal arrives after the Fusaka upgrade raised block limits and further optimized Ethereum’s throughput.

Coinbase Reopens Indian Market Access for Retail Users

Coinbase has reopened registrations in India after a two-year hiatus, allowing users to trade crypto-to-crypto within its platform. Asia-Pacific director John O’Loghlen said the exchange will add fiat deposits in 2026, restoring direct rupee purchases. The company previously suspended that feature following regulatory friction with India’s Unified Payments Interface operator.

Coinbase recently secured registration with India’s Financial Intelligence Unit and resumed limited onboarding through an early-access program in October. Its return comes despite high taxation, including a 30% income levy and 1% transaction tax on trades. The firm also increased investment in CoinDCX at a $2.45 billion valuation, strengthening its regional foothold and local partnerships.

Data of the day

Decentralized AI network Bittensor will conduct its first halving on Dec. 14, cutting daily TAO emissions from 7,200 to 3,600. The protocol incentivizes contributors through 129 specialized subnets that provide data storage, compute, and intelligence services. Analysts expect reduced supply to heighten scarcity and potentially strengthen TAO’s price trajectory following the event.

Grayscale’s Will Ogden Moore compared Bittensor's halving to Bitcoin’s historical supply reductions that increased network value and investor confidence. Institutional adoption has expanded since February’s launch of dynamic TAO, enabling subnet-level investment and liquidity. Major firms including Yuma Asset Management and Stillcore Capital now hold TAO exposure as the network matures toward its 21 million token cap.

More breaking news

Circle partnered with Bybit to expand USDC adoption globally, boosting liquidity, payments, and savings integrations beyond Coinbase’s ecosystem while strengthening Bybit’s regulatory standing.

Binance obtained three ADGM licenses in Abu Dhabi, granting regulatory approval to operate exchange, clearing, and brokerage services under FSRA’s financial oversight.

Farcaster is pivoting from social networking toward wallet development after failing to scale its social app, focusing on wallet-driven user growth instead.

The SEC closed its 2024 investigation into Ondo Finance without charges, signaling renewed regulatory openness toward tokenized real-world assets in US markets.

Yearn Finance detailed its $9 million yETH exploit, confirmed partial fund recovery, and outlined new safeguards to prevent similar vulnerabilities in future.

Michael Saylor's Strategy purchased nearly $1 billion in Bitcoin, its largest buy in months, expanding holdings to 660,000 BTC despite minimal stock reaction.

Ripple’s $500 million share sale reportedly guaranteed investors annualized profits and liquidation preferences, ensuring returns for firms like Citadel and Fortress.

Argentina’s central bank plans to allow domestic banks to offer crypto services by April 2026, reversing its longstanding ban on digital assets.

ZKsync announced plans to retire its original Lite rollup in 2026, completing its transition toward the zkEVM-based ZKsync Era and Stack ecosystem.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.