- Datawallet Daily

- Posts

- Strategy Stock Surges Following Favorable MSCI Index Ruling

Strategy Stock Surges Following Favorable MSCI Index Ruling

Newsletter Issue #710

GM. Strategy stock jumped 6% after MSCI deferred a plan to purge Bitcoin treasuries from its indices, saving Michael Saylor’s firm from an estimated $9 billion in forced institutional sell-offs.

Meanwhile, Ripple rejected IPO plans after a $500M fundraise, Polymarket signed a data deal with Dow Jones, and Babylon Labs raised $15M to scale native BTC collateral.

Here are the details on index rulings, private funding, and predictive data. 👇

Strategy Stock Surges Following Favorable MSCI Index Ruling

Billionaire Michael Saylor’s Strategy enterprise secured a vital reprieve as global index provider MSCI deferred its planned purge of digital asset treasuries. This decision ensures the largest corporate Bitcoin hoarder remains eligible for trillion dollar institutional portfolios.

The aggressive stock rally ignited during late trading on 6 January 2026 across major New York electronic exchanges. Markets reacted with immediate fervor as the software firm’s shares climbed 6% to approximately $169 following the announcement.

Index committees hesitated to classify these high-beta crypto proxies as passive investment funds despite intense internal pressure. Preserving the current status quo prevents massive forced liquidations that analysts estimated could have reached nearly $9 billion in outflows.

Strategy defended its operational integrity by arguing that its relentless Bitcoin acquisitions represent core business activities rather than idle speculation. By maintaining index neutrality, MSCI effectively stabilized the firm’s valuation while it navigates a broader classification review.

Ripple Rejects Public Listing Following Major Funding Round

Ripple President Monica Long confirmed on Tuesday that the blockchain firm has no plans for an initial public offering. The company recently secured $500 million in a strategic funding round led by Fortress and Citadel Securities. This fresh capital allows the San Francisco based business to scale operations while remaining private during its current global expansion.

The decision highlights a preference for internal funding over the liquidity typically provided by public stock markets. Long explained how the firm completed 4 major acquisitions in 2025 to reinforce its digital asset infrastructure. Management now focuses on integrating these new entities to strengthen cross border payment rails and stablecoin services for institutional clients.

Polymarket Signs Exclusive Data Deal With Dow Jones

Prediction platform Polymarket recently finalized a major partnership to provide real time data to Dow Jones media. This exclusive arrangement integrates blockchain based betting odds into The Wall Street Journal and Barron’s digital platforms. Readers can now view market implied probabilities for various economic and political outcomes directly alongside traditional financial news reports.

The collaboration introduces a unique earnings calendar that uses crowd wisdom to forecast corporate performance for public companies. Executives at Dow Jones believe these decentralized signals offer valuable insights into collective global beliefs about future events. This strategic alliance cements Polymarket’s position as a primary source for predictive intelligence within the mainstream financial publishing industry.

Babylon Labs Raises $15 Million For Native Bitcoin Collateral

Babylon Labs secured $15 million from a16z crypto to scale its trustless vault technology this Wednesday. The project enables users to use native Bitcoin as onchain collateral without relying on custodians or wrapped tokens. This funding round specifically supports the development of BTCVaults which allow for secure borrowing and lending across decentralized financial applications.

The startup’s native token jumped 13% following the announcement of this high profile venture capital investment. Engineers at Babylon are building cryptographic mechanisms to ensure assets remain verifiable on the original Bitcoin base layer. This infrastructure aims to unlock the massive value of idle Bitcoin for productive use within the broader blockchain ecosystem.

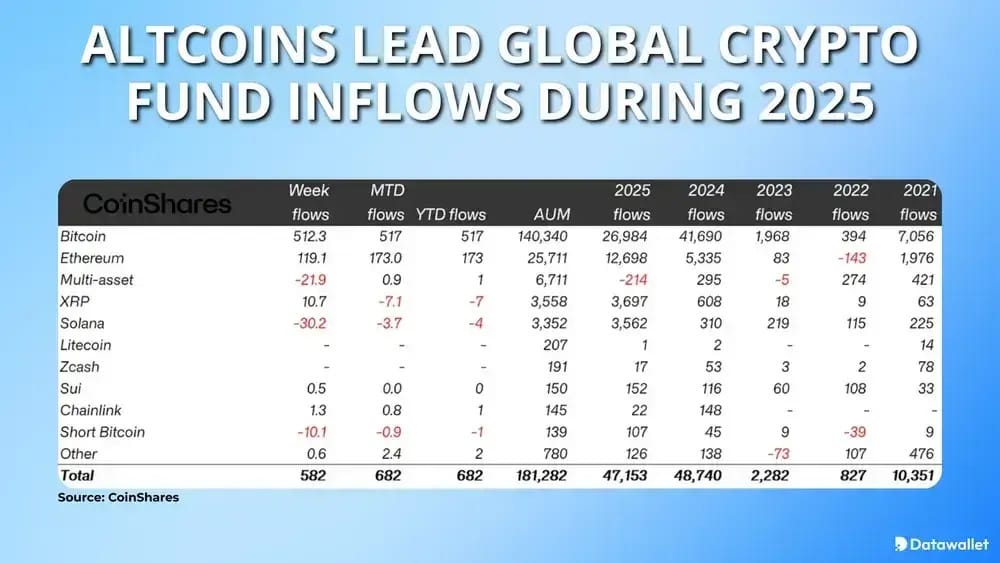

Data of the day

Digital asset investment products attracted $47.2 billion of inflows throughout the 2025 calendar year. Data from CoinShares indicates that Ethereum and Solana led the market while Bitcoin demand saw a 35% drop. Total assets under management reached 180 billion as investors diversified their portfolios beyond the primary cryptocurrency into diverse altcoin funds.

The United States remained the dominant market for these exchange traded products despite a slight annual decline. Germany and Canada recorded major growth as regional investors shifted back into regulated crypto vehicles after previous outflows. This steady activity suggests a maturing market where institutional participants are increasingly comfortable holding a wide variety of decentralized digital assets.

More breaking news

Senator Tim Scott confirmed the Digital Asset Market Clarity Act will face a Senate vote next week to establish a US crypto framework.

Morgan Stanley filed for an Ethereum Trust with the SEC, adding to its recent Bitcoin and Solana exchange-traded fund applications for early 2026.

Community bankers urged the Senate to close a GENIUS Act loophole that allows yield-bearing stablecoins to potentially drain critical deposits from local banks.

Barclays made a strategic investment in US startup Ubyx to build settlement infrastructure that integrates stablecoins into the regulated global financial system.

Lighter launched 24/5 equity perpetuals trading, allowing global users to speculate on US stocks like Coinbase and Robinhood using crypto.

Tether introduced the Scudo unit, representing 1/1,000th of an ounce of gold, to simplify using its gold-backed XAUT token for everyday digital payments.

Privacy tokens like Zcash and Monero outperformed the market in 2025 as users sought utility-driven anonymity amidst expanding global blockchain surveillance and regulation.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

1