- Datawallet Daily

- Posts

- Tether Launches USAT Stablecoin Under New Federal Oversight

Tether Launches USAT Stablecoin Under New Federal Oversight

Newsletter Issue #724

GM. Tether launched its "Made in America" USAT token under the new GENIUS Act, partnering with Anchorage Digital and Cantor Fitzgerald to satisfy federal banking standards.

Meanwhile, Hyperliquid hit record open interest amid a commodity boom, Arizona advanced a crypto property tax exemption, and Polymarket signed an exclusive prediction deal with MLS.

Here are the details on regulated stablecoins, record volumes, and soccer sentiment. 👇

Tether Launches USAT Stablecoin Under New Federal Oversight

Stablecoin juggernaut Tether launched its "Made in America" USAT token to capture the lucrative domestic market under a newly established regulatory regime. This historic maneuver leverages their massive liquidity to challenge established competitors on their own turf.

The formal market introduction transpired on 27 January 2026 across major digital asset exchanges, including Kraken and OKX. This strategic timing coincides with the recent enforcement of the GENIUS Act, which clarified federal stablecoin issuance rules.

Former White House advisor Bo Hines oversees this specific expansion to ensure alignment with the current administration’s pro-innovation priorities. Leadership prioritizes transparency and institutional trust to facilitate mass adoption across the broader American financial system.

The protocol achieves compliance by utilizing Anchorage Digital Bank as the acting issuer while Cantor Fitzgerald manages all reserve custody. Users must utilize these regulated onramps to access a dollar-backed utility that satisfies rigorous federal banking standards.

Hyperliquid Hits Record Open Interest On Commodity Boom

Hyperliquid reached a record $793 million in open interest this Monday following a surge in commodity trading. The platform’s HIP-3 framework allows builders to launch permissionless perpetual contracts for any asset with a reliable price feed. This milestone comes as on-chain derivatives volume on the network surpassed $25 billion since its mid-October debut.

Builders must stake 500,000 HYPE to deploy these markets and capture a portion of the trading fees. The current boom in precious metals pushed gold above $5,000 this week while the crypto market largely lagged. Most of this recent Hyperliquid activity originated from the TradeXYZ market, which currently tracks major global stock indices and metals.

Arizona Senate Committee Advances Crypto Tax Exemption

The Arizona Senate Finance Committee approved two measures on Monday to exempt virtual currencies from property taxes. Senate Bill 1044 and a concurrent resolution were passed with a 4-3 vote to advance toward the Rules Committee. If successful, a constitutional amendment will appear on the November ballot to let voters formalize this specific tax relief policy.

State Senator Wendy Rogers introduced the legislation to establish Arizona as a premier hub for the digital economy. These bills define virtual currency as a digital representation of value that functions as a medium of exchange. While Governor Katie Hobbs vetoed 4 similar bills in 2025, proponents believe voter approval could bypass previous executive resistance.

Polymarket Signs Exclusive Prediction Partnership With MLS

Polymarket recently finalized an exclusive licensing agreement with Major League Soccer to improve fan engagement through data. The deal covers major events like the MLS Cup and the All-Star Game during the 2026 professional season. Polymarket users will access real-time collective sentiment and second-screen interactive tools during live matches to track key season-long storylines.

This partnership follows a series of high-profile deals between prediction markets and major global sports organizations. CEO Shayne Coplan noted that US soccer fans are increasingly seeking immersive ways to interact with the world's most popular sport. To protect game integrity, both parties plan to implement independent monitoring of all trading activity linked to these matches.

Data of the day

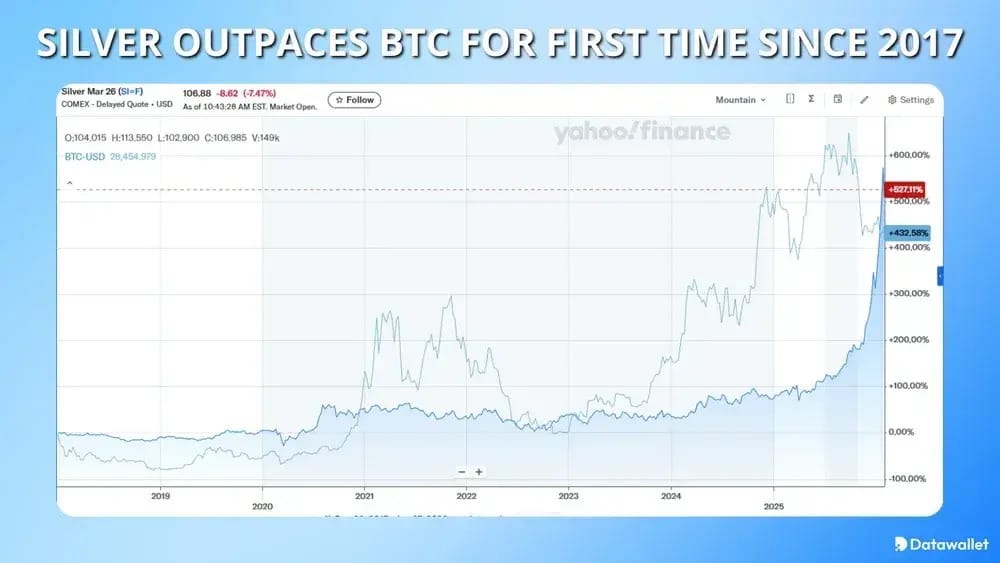

Silver prices surged to a new record of $117 per ounce this Monday before settling near the $105 level. This rally means silver has gained 517% since late 2017, which officially outpaces Bitcoin's 500% rise during the same period. While precious metals reached historic milestones, the crypto market struggled to maintain momentum amid serious spot ETF outflows.

Trading volume for the iShares Silver Trust exploded to $32 billion during the single session on Monday. This turnover briefly surpassed the daily activity of major equity funds and popular tech stocks like Nvidia. Analysts attribute the surge to a structural shift as investors rotate into physical hedges during a period of heightened geopolitical tension.

More breaking news

Standard Chartered warned that stablecoins could attract $500 billion from US bank deposits by 2028, posing a major structural risk to regional lenders.

A cybersecurity researcher discovered a massive database containing 149 million stolen credentials, including over 420,000 login records specifically linked to Binance user accounts.

Bitcoin Layer 2 Citrea launched its mainnet and ctUSD stablecoin, using zero-knowledge proofs to enable BTC-backed lending and institutional financial applications.

Australia’s corporate regulator identified major regulatory gaps in unlicensed crypto and AI firms, warning that rapid innovation is currently outpacing consumer protections.

Theo introduced thGOLD, a yield-bearing tokenized gold product that allows investors to earn interest through secured lending against physical bullion inventories.

Japan’s Financial Services Agency launched a public consultation to define high-rated foreign bonds eligible for stablecoin reserves under the nation's amended payments law.

Kalshi opened a Washington office and hired veteran political strategists to lead federal lobbying efforts amid ongoing state-level legal battles.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.