- Datawallet Daily

- Posts

- Tom Lee’s Bitmine Ethereum Treasury Begins Staking

Tom Lee’s Bitmine Ethereum Treasury Begins Staking

Newsletter Issue #703

GM. Tom Lee’s Bitmine is doubling down on Ethereum, adding 44,000 ETH and beginning large-scale staking as it moves toward owning 5% of the network.

Meanwhile, Ethereum developers lock in 2026 upgrade plans, Strategy resumes Bitcoin buying, and China greenlights interest payments on its digital yuan.

Here’s what’s moving crypto to close out the year. 👇

Tom Lee’s Bitmine Ethereum Treasury Begins Staking

Bitmine Immersion Technologies disclosed on Monday it added 44,463 Ether last week, lifting holdings to roughly 3.41% of Ethereum’s circulating supply. The move reinforces an aggressive treasury strategy aimed at ultimately acquiring five percent of the entire network.

The accumulation follows Bitmine’s announcement that it surpassed four million ETH, capitalizing on pronounced year-end market softness across crypto markets. Chairman Tom Lee said tax-loss selling conditions made the firm the largest fresh Ether buyer in the world.

At prevailing prices, Bitmine’s Ether treasury exceeds $12 billion, pushing total crypto and cash holdings to roughly $13.2 billion on its balance sheet. Company disclosures list 4.11 million ETH, 192 Bitcoin, and approximately one billion dollars in cash as of Dec. 28.

Bitmine has started staking more than 408,000 ETH, generating yield ahead of its Made in America Validator Network launch. BMNR shares trade near $28.50 after weekly declines, while ether changes hands around $2,950 today in recent sessions.

Ethereum Developers Target Hegota Upgrade in 2026

Ethereum developers agreed on the Hegota upgrade name and timing, targeting late 2026 during recent roadmap discussions. Hegota will follow the Glamsterdam upgrade, expected during the first half of 2026, accelerating Ethereum’s protocol release cadence. Core contributors said the faster schedule responds to community criticism over slow development amid rising network usage.

Developers plan to finalize Glamsterdam’s feature scope in January, delaying formal Hegota proposals until at least February. Early discussions point to deferred upgrades, including Verkle Trees, aimed at reducing node storage and verification requirements. The upgrade naming follows Ethereum’s Devcon city and star convention, combining Bogota and Heze references.

Strategy Resumes Bitcoin Buying After Brief Pause

Strategy purchased 1,229 Bitcoin for about $108.8 million between Dec. 22 and Dec. 28 filings show. The acquisition was funded through at-the-market share sales, issuing 663,450 MSTR shares during the same period. Founder Michael Saylor hinted at renewed purchases on X after a short accumulation pause.

The purchase lifted Strategy’s holdings to 672,497 Bitcoin, acquired at an average cost of about $74,997 per coin. At current prices near $87,300, the holdings are valued around $58.7 billion, reflecting unrealized gains exceeding $8 billion. Analysts remain divided, citing liquidity strength versus exposure to prolonged Bitcoin drawdowns.

China Approves Interest Payments on Digital Yuan

China’s central bank announced banks will pay interest on digital yuan balances starting Jan. 1, 2026. The policy shifts the e-CNY from digital cash toward deposit-style treatment under regulated banking frameworks nationwide. Officials said the initiative seeks to encourage adoption after years of pilot programs and limited consumer uptake.

Banks will apply interest rates under existing deposit pricing rules, with balances protected by China’s deposit insurance system. As of November 2025, China processed 3.48 billion e-CNY transactions totaling 16.7 trillion yuan in value. Authorities continue promoting cross-border pilots while maintaining bans on cryptocurrency trading and mining.

Data of the day

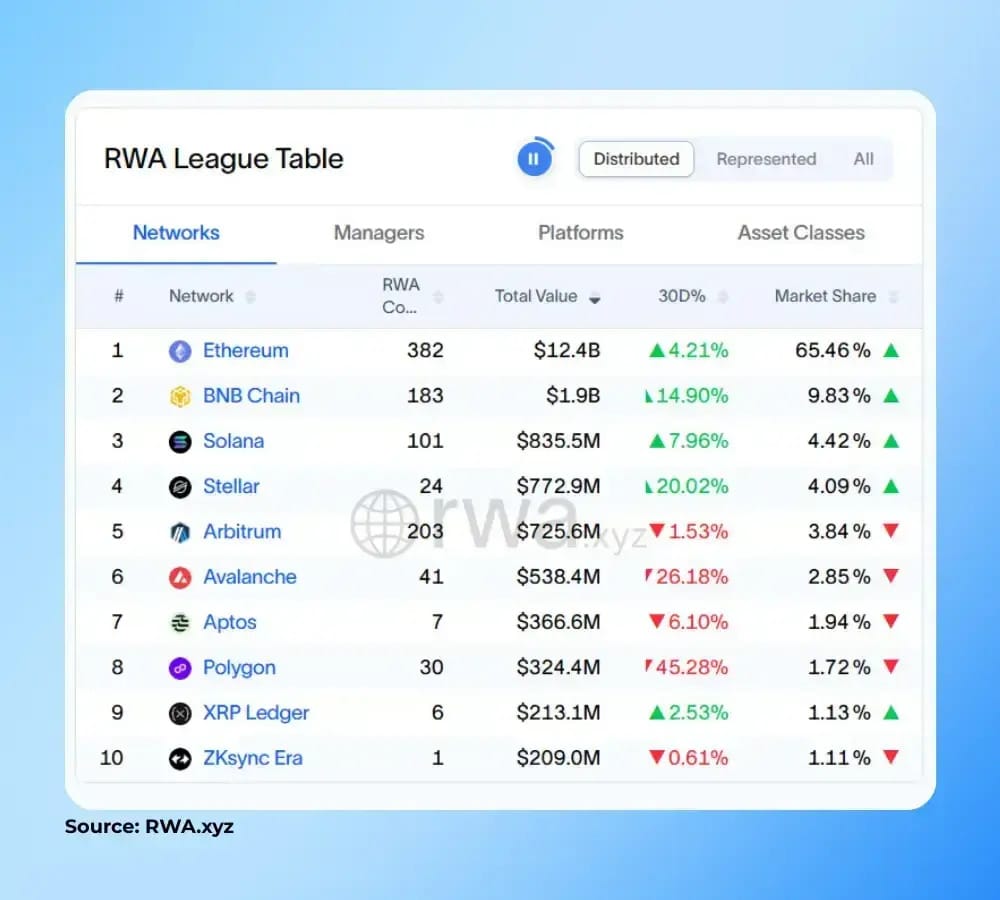

Real-world asset protocols surpassed decentralized exchanges to become DeFi’s fifth-largest category by total value locked. DefiLlama data shows RWA TVL reached about $17 billion, rising from $12 billion in Q4 2024. Tokenized Treasurys and private credit drove growth as institutional participation expanded onchain.

Ethereum remains the dominant settlement layer, while secondary networks capture low single-digit RWA market shares. Tokenized commodities now approach $4 billion in market value, led by gold-backed products tracking spot prices. Analysts expect adoption to persist into 2026 as RWAs integrate deeper into collateral and liquidity systems.

More breaking news

Major blockchains processed more transactions in December even as fee revenue dropped, highlighting improved scalability and easing blockspace congestion across networks.

Tokenized silver volumes surged over 1,200% this month as record metal prices and supply strains drove investors to seek onchain commodity exposure.

North Korean hackers stole over $2.1 billion in crypto during 2025, refining laundering tactics and exploiting global platforms to fund the sanctioned regime.

Sberbank issued Russia’s first Bitcoin-backed loan to mining firm Intelion Data, using its custody tool to secure collateral under pilot lending terms.

For the first time in six months, Ethereum's staking queue has flipped the exit line, with nearly twice as much ETH waiting to be staked as ETH attempting to exit the network.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.