- Datawallet Daily

- Posts

- Uniswap Approves UNIfication Fee Switch & Token Burns

Uniswap Approves UNIfication Fee Switch & Token Burns

Newsletter Issue #702

GM. Uniswap has officially approved its UNIfication overhaul, activating the long-debated fee switch and UNI token burns after near-unanimous community backing across 125 million votes.

Meanwhile, Caroline Ellison’s release date is set, Coinbase confirms an arrest over its India breach, and Flow investigates a possible exploit behind its sharp token crash.

Here’s the latest in crypto to start the week. 👇

Uniswap Approves UNIfication Fee Switch & Token Burns

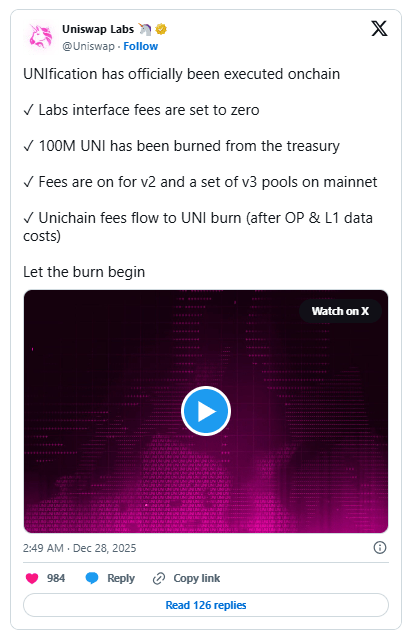

Uniswap governance passed the UNIfication proposal, approving a sweeping economic shift that activates the long-awaited protocol fee switch and introduces continuous token burning. More than 125 million UNI voted yes, delivering near-unanimous community support overall.

The proposal, introduced by Uniswap Labs and the Uniswap Foundation, redirects a portion of trading fees from liquidity providers to the protocol itself. Those fees, plus Unichain sequencer revenue, will be used to burn UNI tokens.

After a two-day timelock, Uniswap will immediately burn 100 million UNI, retroactively simulating supply reductions missed since the token’s launch. The proposal also consolidates Foundation operations into Labs and establishes a UNI-funded annual growth budget for development.

The shift follows years of regulatory scrutiny, with Uniswap arguing DeFi has reached a mainstream inflection under a changing US climate. UNI traded near $5.92 after the announcement, up nearly 19% weekly as fees topped $1.05 billion this year.

Caroline Ellison Scheduled for January Federal Release

Former Alameda Research executive Caroline Ellison is scheduled for release from federal custody on January 21, 2026. Bureau of Prisons records show Ellison has been in community confinement since October following transfer from Connecticut. She pleaded guilty in December 2022 to fraud charges tied to the 2022 FTX collapse.

Ellison received a two-year sentence in November 2024 after cooperating extensively with prosecutors against Sam Bankman-Fried. Judge Lewis Kaplan also ordered forfeiture of $11 billion, reflecting losses tied to Alameda and FTX operations. Earlier this month, Ellison agreed to a 10-year ban from serving as officer of crypto firms.

Coinbase Confirms Arrest Tied to India Breach

Indian authorities arrested a former Coinbase support agent in Hyderabad over a data breach disclosed in May. CEO Brian Armstrong said the arrest followed cooperation with law enforcement after insiders sold user data. The breach exposed 69,461 users and involved names, addresses, phone numbers, and government identification documents.

Coinbase reported $307 million in breach-related expenses and refused a $20 million ransom demand. Investigators linked the breach to outsourced staff at TaskUs, which identified multiple compromised employees. Armstrong said further arrests are expected as investigations continue across jurisdictions.

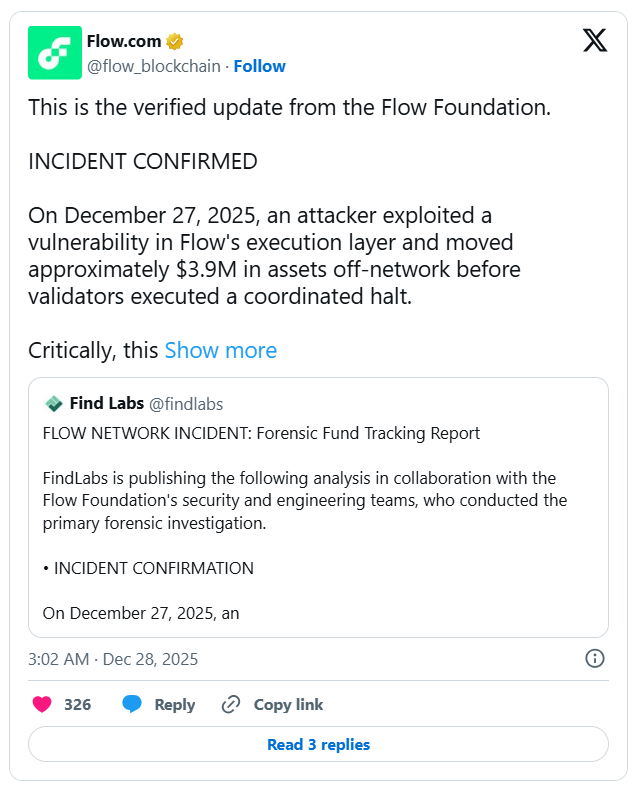

Flow Probes Exploit After Token Price Collapse

The Flow Foundation is investigating a potential security incident after the FLOW token plunged more than 40%. South Korean exchanges halted transfers as analysts estimated roughly $4 million in losses from unauthorized token minting. Onchain data suggests a private key compromise allowed attackers to mint wrapped FLOW and bridged assets.

FLOW fell from about $0.17 to $0.10 as trading volume surged above $170 million. Exchanges, including Upbit and Bithumb, issued transaction risk warnings through Korea’s Digital Asset Exchange Alliance. The incident follows a broader rise in private key attacks, which accounted for 88% of stolen crypto funds.

Data of the day

Zcash shielded transactions now represent roughly 23% of supply, up from about 8% early 2025. The increase reflects sustained usage rather than speculative trading, according to onchain adoption metrics. Shielded usage has remained stable even as broader market attention shifted elsewhere.

Privacy adoption is expanding beyond Zcash, with projects like Monero also seeing renewed engagement and development. Analysts note growing demand as stablecoin payments and onchain commerce expose wallet balances and histories. The data suggests privacy coins remain essential as crypto shifts toward everyday payment use cases.

More breaking news

Spot Bitcoin ETFs recorded $782 million in Christmas week outflows, extending a six-day streak as analysts blamed thin liquidity and year-end positioning.

Trust Wallet launched a compensation process for victims of its $7 million Chrome extension hack, pledging full reimbursement after patching the malicious update.

Mirae Asset Group is in talks to acquire South Korea’s licensed exchange Korbit for up to $100 million, expanding its regulated digital asset presence.

Bitfinex’s Jesse Knutson said emerging markets will lead real-world asset tokenization, using blockchain rails to attract capital and bypass legacy financial infrastructure.

Bitmine began staking $219 million in Ether as its holdings surpassed 4 million ETH, marking a major shift toward yield generation and network participation.

JPMorgan froze accounts tied to stablecoin startups BlindPay and Kontigo over sanctioned-region exposure, tightening compliance amid rising banking scrutiny of crypto payments.

Aave founder Stani Kulechov denied using a $15 million AAVE purchase to sway a governance vote, calling it a personal show of long-term conviction.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.