- Datawallet Daily

- Posts

- Uniswap Proposes Fee Activation and 100M UNI Burn

Uniswap Proposes Fee Activation and 100M UNI Burn

Newsletter Issue #669

GM. Uniswap proposed activating protocol fees and burning 100 million UNI, merging its entities under a single “UNIfication” plan that sent the token soaring nearly 30%.

Meanwhile, China accused the US of seizing $13B in Bitcoin, the IRS cleared crypto ETPs to stake assets, and Coinbase launched regulated UK savings accounts with 3.75% yield.

Here’s what’s fueling DeFi reform, policy clashes, and financial convergence. 👇

Uniswap Proposes Fee Activation and Massive UNI Burn

Uniswap Labs and the Uniswap Foundation unveiled the “UNIfication” proposal on Monday, outlining plans to activate protocol fees and merge both entities. The overhaul would redirect trading revenues toward token holders while burning 100 million UNI tokens sitting in the protocol’s treasury since launch.

The proposal aims to permanently reduce supply through a continuous burn mechanism funded by fees from both the Uniswap DEX and Unichain sequencer. UNI surged nearly 30% to $8.65 following the announcement, outpacing the broader DeFi market amid renewed optimism around governance-led value capture.

Co-authors Hayden Adams, Devin Walsh, and Kenneth Ng said the update would “align incentives” and end years of regulatory hesitation around the long-debated “fee switch.” The plan also halts Uniswap Labs’ front-end, wallet, and API fees, previously totaling $137 million in cumulative revenue.

Uniswap currently processes roughly $650 million in daily volume and has generated over $5.4 billion in total fees since inception. Under the new model, protocol usage will directly drive UNI burns, positioning Uniswap to rival centralized exchanges in scale and efficiency.

China Accuses the United States of Seizing $13B in Bitcoin

China’s cybersecurity watchdog has accused the United States of unlawfully seizing 127,000 BTC from a 2020 mining pool hack. The China National Computer Virus Emergency Response Center claimed the assets were stolen from LuBian, not obtained from criminal proceeds. Its report linked wallets in the US Department of Justice case against Cambodian businessman Chen Zhi to the same 2020 breach.

CVERC alleged the Uinted States used state hacking operations to acquire the coins, calling it a “black-eats-black” act. Blockchain data suggests the Bitcoin stayed untouched for years before being moved to US-tagged wallets in 2024. TRM Labs confirmed the funds originated from Chen’s unhosted wallets, though researchers said access details remain unclear.

IRS Allows Crypto ETPs to Stake Digital Assets

The Internal Revenue Service introduced new guidelines creating a safe harbor for exchange-traded products staking digital assets. Treasury Secretary Scott Bessent said the framework lets funds distribute staking rewards to investors while maintaining compliance and tax recognition. The clarification follows the SEC’s earlier statement that proof-of-stake participation does not constitute a securities transaction under US law.

The 18-page notice outlines limits and custody requirements for ETPs staking assets on permissionless networks. Legal experts said the move transforms staking from a regulatory risk into an accepted institutional activity. Market analysts expect the change to expand institutional participation by enabling ETFs and trusts to earn yield on staked holdings.

Coinbase Launches Regulated UK Savings Accounts

Coinbase announced a new UK savings account offering 3.75% variable interest through its banking partner Clearbank. Starting November 11, eligible users can deposit pounds, earn daily interest, and withdraw funds instantly without balance limits or lockups. Coinbase said all deposits will qualify for Financial Services Compensation Scheme protection up to eighty-five thousand pounds.

Executives described the account as a milestone in blending crypto and traditional finance within the firm’s UK ecosystem. The company said it plans to extend access to all verified users in the coming weeks. The move comes as Coinbase faces renewed scrutiny following regulatory fines in Ireland and the United Kingdom.

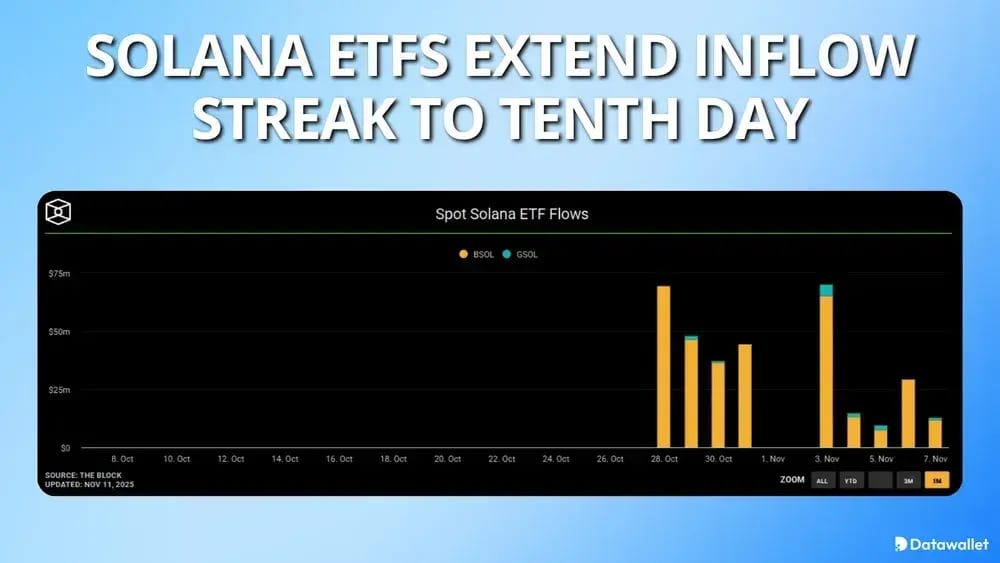

Data of the day

Spot Solana exchange-traded funds in the United States recorded ten consecutive trading days of positive net inflows. Data from SoSoValue showed combined inflows of $6.8 on Monday, led by Bitwise’s BSOL product. Together with Grayscale’s GSOL, both funds have accumulated more than three hundred forty million since launching on October 28.

Analysts said institutional demand has exceeded expectations despite concerns over Solana’s regulatory and network risks. Bloomberg’s Eric Balchunas called the trend a positive sign for alternative crypto ETFs gaining credibility. LVRG Research said consistent inflows may strengthen Solana’s price floor by tightening supply and drawing institutional liquidity.

More breaking news

Chinese fraudster Zhimin Qian received an 11-year prison sentence in London after orchestrating a $6.3 billion Bitcoin pyramid scheme defrauding over 120,000 victims.

Lighter perpetuals DEX raised $68 million at a $1.5 billion valuation, posting $279 billion in monthly trading volume ahead of its token launch.

Bitcoin miner CleanSpark announced a $1 billion convertible note offering to fund share buybacks, data center expansion, and repayment of bitcoin-backed debt lines.

Gemini shares slid 12% after-hours as its first post-IPO earnings showed rising expenses and losses despite record credit-card spending and strong user growth.

Trading platform eToro reported $3.97 billion in crypto revenue for Q3, up sharply year over year, though rising costs eroded nearly all profit margins.

Injective launched a native Ethereum Virtual Machine layer, merging EVM compatibility with its high-speed infrastructure to enable faster, cheaper decentralized finance applications.

Argentina froze assets tied to the Libra token scandal, targeting Hayden Davis and others accused of orchestrating a $250 million memecoin “rug pull.”

JPMorgan and DBS Bank unveiled a joint framework to connect tokenized deposit systems across blockchains, enabling 24/7 interoperable cross-border settlements for institutions.

Jack Dorsey’s Square enabled Bitcoin payments for over 4 million merchants globally, launching a fee-free checkout option and live map of participating businesses.

.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.