- Datawallet Daily

- Posts

- Visa Opens USDC Stablecoin Settlement on Solana

Visa Opens USDC Stablecoin Settlement on Solana

Newsletter Issue #694

GM. Visa launched USDC settlement on Solana, bringing onchain payments to U.S. banks and unlocking 24/7 programmable dollar rails for traditional finance.

MetaMask added native Bitcoin support, OKX rolled out spot margin trading in Europe, and PancakeSwap unveiled “Probable,” its new BNB Chain prediction platform.

Here are the latest crypto headlines you should know. 👇

Visa Opens USDC Stablecoin Settlement on Solana

Visa launched stablecoin settlement using USDC on Solana, opening blockchain rails to American banking partners. The payments giant enabled issuers and acquirers to settle transactions onchain, starting with Cross River Bank initially nationwide.

Visa said banks want programmable settlement, citing faster fund movement and 7-day availability versus traditional 5-day cycles. USDC settlement improves treasury efficiency while meeting Visa compliance standards, after global pilots expanded steadily since 2023.

The rollout starts with Cross River Bank and Lead Bank, leveraging Solana throughput for always-on settlement infrastructure. Visa reported stablecoin volumes exceeding a $3.5 billion annualized run rate as pilots scale across multiple regions.

The US expansion follows regulatory clarity from the GENIUS Act, accelerating institutional adoption of compliant dollar rails. Visa plans broader rollout through 2026 and future USDC settlement on Circle’s Arc network with validator operations planned.

MetaMask Wallet Adds Native Bitcoin Support

MetaMask added native Bitcoin support on Monday, allowing users globally to buy BTC with fiat and transact onchain. The update lets users swap BTC with EVM assets and Solana tokens directly inside the wallet. Consensys confirmed the rollout follows earlier launches including Solana support, Polymarket access, and Hyperliquid-powered perpetuals trading.

Initially, MetaMask supports native SegWit Bitcoin addresses, with Taproot compatibility planned for a near-term release. The wallet previously enabled Bitcoin-related functionality through Snaps, including access to Bitcoin Layer 2 networks like BOB. The Bitcoin expansion aligns with Consensys IPO preparations and an upcoming MASK token rewards rollout.

OKX Exchange Launches Spot Margin Trading Europe

OKX opened up spot margin trading across Europe on Tuesday, enabling traders to apply leverage up to 10x. The feature allows users to borrow funds against portfolio collateral when trading BTC and ETH spot pairs. The rollout follows MiCA implementation, enabling regulated platforms to introduce leveraged products under European oversight.

OKX confirmed initial support includes BTC USDC and ETH USDC pairs with cross-margin functionality. Several regulated competitors including Kraken, Bitpanda, and Bybit EU already offer similar leverage limits. OKX Europe CEO Erald Ghoos said the launch balances regulatory compliance with institutional-grade trading infrastructure.

PancakeSwap Incubates "Probable" Prediction Platform

PancakeSwap unveiled Probable, a prediction markets platform incubated with YZi Labs and launching exclusively on BNB Chain. The platform will support crypto prices, global events, sports outcomes, and regional markets using UMA Optimistic Oracle settlement. Probable will initially charge no fees and automatically convert deposits into USDT on BNB Chain.

PancakeSwap said Probable operates independently despite early incubation support and did not provide a launch date. Prediction markets gained momentum after Kalshi and Polymarket posted billions in monthly volumes since October. Coinbase, Gemini, MetaMask, and Robinhood have since announced prediction market integrations or related initiatives.

Data of the day

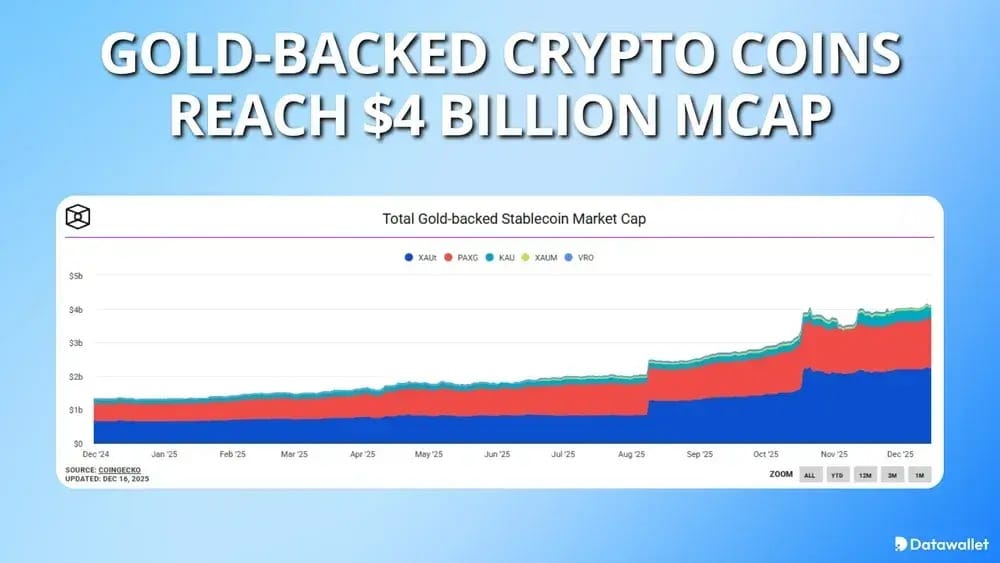

Gold-backed stablecoins surpassed $4 billion market capitalization in 2025, nearly tripling from $1.3 billion earlier. The growth reflects rising gold prices and increased investor demand for tokenized safe-haven assets. Gold prices rose approximately 66% year-to-date amid geopolitical risks and persistent macroeconomic uncertainty.

Tether Gold leads with $2.2 billion market capitalization, followed by Paxos Gold at roughly $1.5 billion. Together, XAUt and PAXG represent nearly 90% of the gold-backed cryptocurrencies market. Tether holds approximately 116 tons of gold, ranking among the top 30 global gold holders.

More breaking news

Gemini launched its regulated Gemini Predictions platform across all 50 US states after receiving CFTC approval, expanding its “super app” strategy.

American Bitcoin, backed by Eric and Donald Trump Jr., entered the top 20 corporate Bitcoin holders as its stock extended steep losses.

Spain’s CNMV published detailed MiCA guidance outlining authorization, cross-border procedures, and shortened transition deadlines for crypto-asset service providers operating in the country.

The UK’s FCA found crypto ownership dropped to 8% in 2025, though average holdings grew as centralized exchanges dominated access.

Bitget began beta testing TradFi trading with forex, gold, and stock derivatives using USDT collateral, uniting traditional and crypto markets on one platform.

Cathie Wood’s Ark Invest bought $56 million in crypto-linked equities including BitMine, Coinbase, and Circle, betting on long-term recovery amid market weakness.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.